Zobrazení pro čtení

Apple's latest iOS 18 beta walks back some changes to the redesigned Photos app

Apple is pumping the brakes on some of its updates to the Photos app in iOS 18. The company made some changes — removing some features and tweaking others — on Monday to address user feedback. The pared-down version can be found in the software’s fifth developer beta, which app makers can install today.

The biggest change is that Apple removed the Carousel from the Photos app altogether. The iOS 18 feature used “on-device intelligence” (which, confusingly, isn’t the same as Apple Intelligence) to aggregate what it thought was your best content, placing them in a swipeable row. Previously found to the right of the photo grid, it’s now gone altogether, helping Apple clean up one of the features that earned a healthy dose of complaints from beta testers.

In addition, Apple tweaked the All Photos view in today’s update to show more of the photos grid. The company also added Recently Saved content to the Recent Days collection. Finally, Apple made albums easier to find for users with more than one. (The difficulty of locating that section was a frequently echoed complaint among testers.)

Apple pitched the changes to the Photos app as one of the pillars of its 2024 software update. Although the app is streamlined into a single view and designed to be more customizable, it too often ends up as a mishmash of extra features most people won’t need, sometimes getting in the way of finding what you’re looking for.

A Reddit thread from July with over 1,000 upvotes gave voice to some of the most frequent complaints. “Once again taking a rapid-use app and making it into an experience for no reason,” u/thiskillstheredditor commented. “I just want a camera roll and maybe the ability to sort photos by location. It was perfectly fine, if maybe a bit bloated, before. But this is an unmitigated mess.”

Time will tell if today’s updates are enough to clean up the app’s user experience ahead of iOS 18’s fall launch to the public. The changes aren’t yet in the public beta but will likely appear there in the next version or soon after.

This article originally appeared on Engadget at https://www.engadget.com/apples-latest-ios-18-beta-walks-back-some-changes-to-the-redesigned-photos-app-180145232.html?src=rss© Apple

Taco Bell will add voice AI ordering to hundreds of drive-thrus this year

Next time you're craving a chalupa supreme, you might not be ordering from a person. Taco Bell is expanding its program for using AI voice recognition in drive-thrus. After testing the technology in more than 100 locations in 13 states, the fast food chain's parent company aims to add voice-powered AI capabilities to hundreds more Taco Bell drive-thrus in the US by the end of the year.

"With over two years of fine tuning and testing the drive-thru Voice AI technology, we’re confident in its effectiveness in optimizing operations and enhancing customer satisfaction," said Lawrence Kim, chief innovation officer for Yum! Brands. The company also owns KFC and is currently testing Voice AI in five locations for that chain in Australia.

It sounds a little goofy, but in practice, this is an application of AI that people who aren't early adopters might encounter in the wild. There are lots of splashy headlines about chatbots that sound like celebrities, but this type of practical use case shows where and how voice AI might appear in a person's routine and workplace. The press release centers the employee experience as one of the reasons for pursuing the technology. "Tapping into AI gives us the ability to ease team members’ workloads, freeing them to focus on front-of-house hospitality. It also enables us to unlock new and meaningful ways to engage with our customers," Taco Bell Chief Digital & Technology Officer Dane Mathews said.

That's the positive side. On the negative side, there are still plenty of imperfections yet to be resolved in the tech. McDonald's ran a similar effort exploring drive-thrus powered by AI, but called off its program earlier this summer. Customers had encounters that were equal parts frustrating and hilarious with the AI ordering options during the testing phase. There's also a concern that if the kinks in these AI systems do get worked out, the easing of team members' workloads could turn into losing some team members' jobs.

This article originally appeared on Engadget at https://www.engadget.com/taco-bell-will-add-voice-ai-ordering-to-hundreds-of-drive-thrus-this-year-141110768.html?src=rss© REUTERS / Reuters

watchOS 11 lets you take a day off working out without losing your streak

Many of the new features coming to watchOS 11 are fitness-focused, with a new Training Load feature for the Activities app, pregnancy stats in Cycle Tracking and a brand new Vitals app. Apple's Worldwide Developers Conference (WWDC) on Monday showcased all the things we can expect when the operating system update for Apple Watches hits this fall.

The new app, Vitals, synthesizes data gathered overnight to give you a better understanding of your overall health. Apple Watch sensors will monitor details like heart rate, wrist temperature and respiration and combine that with data from the Apple Heart and Movement study so it can track changes over time and give you a heads up when things look outside their normal range. From what we've seen, Apple Watch batteries (outside of the Ultra model) don't quite make it through a night after a full day of use, so it'll be interesting to see how useful the new app will prove.

The Activity app is getting a few new abilities, including Training Load that measures the intensity and duration of your workout to see how it's impacting you over time. Using data from GPS, sensor metrics like heart rate and pace, as well as your personal details like age and weight, the app will determine a rating for each workout from one (easy) to 10 (all out). And if you don't agree with the assessment, you can manually adjust it. In a post workout summary, you can see if you're training above your average or below it.

The Workout app within the Apple Watch will now include a Check In button to let friends and family know when you're heading out and back home safe from a run.

Using your iPhone, you can set more customizations in the Activity app too. Now you can adjust your goals for the day of the week and set rest days while still hanging onto your streaks. The summary screen in the Fitness app on iPhone is customizable too.

The Cycle Tracking app can now give you insights during pregnancy, showing applicable health data as it tracks the duration of your pregnancy. This includes a look at your heart rate, which typically rises during pregnancy, as well as a running timeline of the gestational age. Walking stability alerts during the third trimester can also help you avoid falling issues that sometimes arise. Mental health will also get some attention, with reminders to take a monthly assessments to keep you aware of issues that pregnancy and postpartum conditions can trigger, like depression.

Smart Stack — the rolling list of active app widgets you access by swiping up from the bottom of the screen — is getting some updates as well. Now instead of just active apps, the Smart Stack will include time sensitive widgets like precipitation alerts before it rains or the translate widget when traveling. That alerted us to the fact that the Translate app is coming to the Apple Watch, with translation support for 20 languages. Live Activities and Check In will come to the Smart Stack, too.

Apple is opening up access to the Smart Stack to third parties. So, for example, you'll see that your Uber is arriving in the widget carousel. Developers will have access to the Double Tap feature as well, for hands-free interaction with more apps.

If you like the Photos watch face, there's good news here too. Machine learning models will help you find the best photos to feature by identifying and scoring the images of your friends and family based on facial expressions and image composition. It can even automatically crop and frame them for you.

Almost as an afterthought, Apple also mentioned the advent of turn-by-turn directions for hiking and walking routes you created yourself.

If you're itching to try out the new features for yourself, you can do so next month if you're part of Apple's beta software program. Developers gained access as of the announcement. And for regular folk, watchOS 11 will be available as a free software update this fall for Apple Watch Series 6 and newer.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/watchos-11-includes-a-new-vitals-app-to-see-all-your-key-health-metrics-175600647.html?src=rss© Apple

iOS 18 embraces Apple Intelligence, deeper customization and a more useful Siri

WWDC is always where we learn about the year's biggest updates to Apple's operating systems. Given that the iPhone is Apple's most important product, it's no surprise that iOS takes up a major chunk of the attention each June. WWDC 2024 is no exception, as Apple had a ton of new features and updates to go over, many of which concerned AI (or Apple Intelligence, as the company is calling it).

Apple Intelligence

Apple Intelligence is all over iOS 18, as well as iPadOS 18 and macOS Sequoia. Apple is using a blend of its own tech and capabilities powered by OpenAI (as was widely expected). ChatGPT will be integrated into Apple Intelligence too.

As part of this new era, Siri is getting a major overhaul. The voice assistant will be able to get much more done as it will be more deeply integrated into your apps and have more contextual awareness. You'll be able to use Siri for things like photo editing, rewriting emails and prioritizing notifications. There's the option to type your Siri commands as well, which is a nice accessibility upgrade.

The language models will be able to rewrite, proofread and summarize text for you in apps such as Mail, Notes, Safari, Pages and Keynote, as well as third-party apps. Image generation will be available too in sketch, illustration and animation styles — so you won't be able to generate realistic images using Apple's tech. Image generation is built into apps such as Notes, Freeform and Pages.

You'll be able to use natural language prompts to search for photos of certain people. There's also the promise of more intelligent search in the browser and (at long last!) transcriptions of calls and Voice Memos to catch up to a feature Pixel devices have had for a while.

Although Apple Intelligence will pull from your personal information to make sure the systems are applicable to you, it will be aware of your personal data without collecting it, according to Apple software engineering SVP Craig Federighi.

Apple is employing a blend of both on-device and cloud-based AI processing. Your iPhone will handle as much of the legwork locally as it can, with more complex operations being sent to Apple's processing centers. That raises some questions about privacy, one of Apple's central selling points to would-be customers (especially after Apple openly took digs at rivals that use cloud servers for data processing), but Federighi gave some answers to those.

For one thing, the company has established something called Private Cloud Compute. Apple says the aim is to wield the power of the cloud for more advanced AI processing while making sure your iPhone data remains safe and secure.

To use these new features on iOS, you'll need a device that has at least an Apple A17 Pro chipset — in other words, an iPhone 15 Pro or one of this year's upcoming models. Apple Intelligence features will be available for free on iOS 18, iPadOS 18 and macOS Sequoia this fall in US English.

Customization

Apple also focused on customization. You'll be able to make the home screen look more like your own vibe than ever. You'll be able to change the colors of app icons, which can automatically get a different look when you have Dark Mode enabled. Your apps won't need to be locked within a rigid grid anymore either. Your home screen can look almost as messy as you want.

Control Center is getting some big changes. You'll be able to access things like media playback and smart home controls from here. Developers will be able to take advantage of this and offer Control Center management for their apps too. It'll be possible to pin custom controls to the home screen for your most frequently used apps and functions (so you'll be able to switch out the flashlight control for something else, for instance). Custom controls can also be mapped to the physical action button as you see fit.

Messages

When it comes to Messages, there's another nice update in the form of scheduling. When you're catching up on things late at night, you'll be able to time a message to send in the morning, for instance. Those who use emoji reactions in Messages (aka Tapbacks) are getting a nice update too. You'll be able to choose from any emoji instead of the five basic reactions Apple has offered for years.

Text effects (the little animations that show up when you type a certain phrase) are getting an upgrade as well. Meanwhile, Apple will offer satellite messaging support on iPhone 14 and later devices. That's a major update, especially for those who go off the grid often, as messaging will be more useful beyond emergencies. You'll be able to send and receive texts, emoji and Tapbacks via iMessage and SMS.

There's also a key AI-related change coming to the Messages app. Your iPhone will be able to generate custom emoji based on what you're writing. You might need a PhD in semiotics to decipher some of the "Genmoji" you receive.

There's one other big update for Messages in iOS 18: Apple will add support for RCS (Rich Communication Services) to Messages. RCS is a more advanced messaging protocol than SMS. It enables better media sharing, Wi-Fi messaging, group chats and, crucially, better security thanks to end-to-end encryption. It should allow for more secure, media-rich messaging between iPhone and Android devices.

Apple for years refused to support RCS in order to keep iMessage a walled garden. But after persistent pressure from Google — and more importantly, new EU laws coming into force — Apple promised to start supporting RCS sometime this year. Apple, which is never petty about anything ever, almost completely glossed over the addition of RCS in its the keynote, relegating it to a three-word mention.

Apps

The Photos app is getting is biggest redesign ever, Apple says. It's getting a visual overhaul and one of the key aims is to help you find your photos more easily (filtering out screenshots should be a breeze, for one thing). Your snaps will be organized around memorable moments. Apple Intelligence will power features like Clean Up, which is effectively Apple's version of Google's Magic Eraser tool.

The Mail app will soon be able to categorize emails — just like Gmail has for years. Apple will also organize emails by sender and make it easy to archive or delete every email you get from a certain company. This will be optional, so you can stick to a single inbox if you wish.

Maps, meanwhile, will offer more detailed topographic maps to bring the app more into line with the Apple Watch. This should be useful for planning routes while hiking. As for the Journal app, it will now show stats for things like a daily writing streak.

Wallet is getting a handy new feature that will allow you to send cash without having to exchange personal details. All you need to do is simply tap your phones together. This could be handy for splitting the bill after dinner with a new acquaintance. Tickets saved to Wallet can now include stadium details, recommended Apple Music playlists and other information.

Calendar can show events and tasks from Reminders app, while the Notes app can automatically solve any math equations you enter. The Home app will offer guest access

Another welcome change is the introduction of a dedicated Passwords app. This will work across iOS, iPadOS, visionOS and macOS and make it easier to find saved passwords from iCloud Keychain. Even better, there will also be Windows support via the iCloud for Windows app. Hopefully, this will make it easier for everyone to use a password manager and have unique passwords for every single account — something we strongly recommend.

This being Apple, of course it has some new privacy controls for apps in iOS 18. You'll have the option to lock apps behind an authentication method (i.e., your PIN or Face ID) so that when you pass your iPhone to someone to show them your camera roll, they can't go snooping in your Messages. You can also hide apps — perhaps ones you use for dating — in a locked folder too. Elsewhere on the app privacy front, you'll be able to decide which of your contacts an app has access to instead of giving them absolutely everyone's phone numbers and personal information.

Elsewhere, Apple is bringing Game Mode to iPhone. This aims to boost performance by minimizing background activity, while controllers and AirPods should be more responsive.

During an emergency call, dispatchers will be able to send a request to turn it into a video call or to share media from the camera roll. This, Apple suggests, can help first responders better prepare for an incident. The Health app, meanwhile, has been redesigned to make it easier to access vital info in an emergency.

On the accessibility front, users will be able to navigate their iPhone using eye tracking. You'll be able to set up a custom sound that will trigger tasks using the Vocal Shortcut feature, while Music Haptics aims to give those who are deaf or hard of hearing another way to experience music via the Taptic Engine.

A developer beta of iOS 18 is available today and a public version will roll out in July. As always, iOS 18 will roll out to all eligible iPhones this fall.

If your device can run iOS 17, you'll be able to install iOS 18. The list of eligible devices includes the iPhone 11 and later lineups, along with iPhone Xs, Xs Max, Xr and the second-gen SE.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/ios-18-gets-a-revamped-control-center-and-loads-of-home-screen-customization-options-172350046.html?src=rss© Apple

macOS Sequoia will let you see your iPhone mirrored on your Mac's screen

Apple's macOS 15 update is called Sequoia. The 2024 Mac software, coming this fall, includes iPhone mirroring and notification, a new passwords app and Safari upgrades. Of course, it also includes Apple Intelligence. The new software was announced at Apple’s WWDC 2024 keynote at Apple Park.

Like the company’s other 2024 updates, macOS Sequoia includes Apple Intelligence baked in — but only for Apple Silicon Macs with an M1 or newer chip. The system-wide writing tools will work in Mail, Notes, Pages and third-party apps. The AI composition features can rewrite text, proofread and summarize content.

Sequoia also includes Image Playground, Apple’s image generation tool. It lets you create “playful images” in several styles, including animations, illustrations and sketches. The feature is built into Apple’s core apps and has a standalone app.

Typing to Siri also arrives on the Mac in Sequoia, letting you switch between voice and text-based chats with the assistant. You can also use Apple Intelligence’s ChatGPT integration, which asks for user permission to send your requests to OpenAI’s bot.

iPhone mirroring lets you use your Mac to view, control and interact with your phone. It lets you access iOS apps and receive notifications from your nearby handset. Your iPhone screen stays locked in Standby mode (one of iOS 17’s updates) while you work on your computer.

macOS Sequoia also adds a new Windows-like snap window arrangement tool. Drag an app near the screen’s edge, and macOS will automatically suggest where to tile it. You can quickly place windows side by side or in corners. Sequoia will also include new keyboard and menu shortcuts to arrange tiles even faster.

Apple highlighted new video conferencing features in its WWDC keynote. Presenter Preview lets you see what you’re about to share with your call partner(s) before they see it, potentially saving folks some embarrassment. Meanwhile, Background Replacement (as its name implies) lets you swap out your real surroundings for built-in ones or your own photos in video calls.

1Password’s developers are likely squirming today with the introduction of Apple’s new Passwords app. Building on iCloud Keychain and the passwords previously buried in Safari’s settings (and system settings on iPhone and iPad), the standalone app will include all your saved credentials, verification codes and security alerts. It syncs across devices and will also appear on iOS, iPadOS, visionOS and even Windows (via iCloud for Windows).

Safari also gets some upgrades. These include Highlights, which automatically detect relevant info from webpages, and Summaries, which provide AI-fueled recaps of web content in a redesigned Reader mode.

macOS Sequoia has some gaming advancements, including improved Windows porting capabilities in Gameporting Toolkit 2. Apple said it will also be easier to port Mac games to iPad and iPhone, potentially giving developers an extra financial incentive to make or port titles for the Apple ecosystem.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/macos-sequoia-will-let-you-see-your-iphone-mirrored-on-your-macs-screen-180215857.html?src=rss© Apple

WWDC 2024: Everything Apple announced today including iOS 18, AI with Apple Intelligence and more

Today's keynote for Apple's Worldwide Developers Conference teased a lot of what users can expect later this year when all of its major software updates roll out to the public in the fall. Big changes coming to iOS 18, macOS Sequoia and watchOS 11 include RCS support, a new Passwords app, a revamped Calculator app for iPhone and iPad and a bunch of artificial intelligence (AI) infusions across the board thanks to the new "Apple Intelligence" system. If you weren't able to catch the news live, here's a rundown of everything announced at WWDC 2024.

Apple Intelligence

Apple revealed its plans to incorporate AI into its operating systems at WWDC this year. Dubbed "Apple Intelligence," this new generative AI system will appear in iOS and iPad 18 and macOS Sequoia in the form of (what Apple believes to be) practical tools that most people can use regularly. Those features include new writing tools that can help you rewrite, proofread and summarize things like emails and other messages, original emoji and image creation and more. Going hand-in-hand with original image generation is a new feature called Gemoji, which allows users to create their own unique emojis by typing in descriptions and requirements like "T-rex wearing a tutu on a surfboard."

Siri is getting an AI infusion now that it will be powered in part by large language models. In addition to asking Siri to delete an email or edit a photo, users will also be able to ask the virtual assistant to summarize articles and webpages in Safari and even extract personal information from a picture of an ID so it can fill out an online form for them. The company emphasized the importance of "personal context" with Apple Intelligence, which will enable things like using natural language to search for photos that contain only specific family members or friends.

Apple highlighted how most Apple Intelligence actions will be done on-device to make the system as privacy-focused as possible. For queries that cannot be done locally, the work will be sent to Apple's processing centers. The company also created Private Cloud Compute, a feature that's supposed to utilize the cloud for more advanced AI processing while also making sure your data remains secure.

OpenAI's ChatGPT is also integrated into Apple Intelligence, allowing users to give Apple permission to share their queries with ChatGPT "when it might be helpful." Examples provided include asking for menu ideas that incorporate specific ingredients, or asking for decor advice while providing a photo of a space that needs sprucing up. ChatGPT will also work with the AI writing tools coming to iOS and iPadOS 18 in a new Compose feature. ChatGPT integration with iOS 18, iPadOS 18 and macOS Sequoia will roll out later this year, and apparently Apple intends to add support for other AI models in the future — meaning its partnership with OpenAI isn't a long-term exclusive.

iOS 18 and iPadOS 18

The next iPhone software update will roll out to users in the fall and, as expected, one of the biggest changes is support for Rich Communication Service, or RCS. The more-secure messaging protocol offers many improvements over SMS including end-to-end encryption, better media sharing and support for proper group chats. Apple previously stated it would adopt support for RCS in 2024 to comply with EU regulations, so it's unsurprising to see it mentioned in iOS 18's forthcoming features. Also new to Messages will be the ability to "tapback" reply using emojis and stickers, text formatting and effects and the ability to send messages via satellite.

iPhone users will have more control over their home screens in iOS 18 thanks to the fact that it will not be a locked grid system anymore. Users will be able to move app icons a more of a freestyle way, plus they'll be able to change app icon colors as well using a tint color picker. In terms of design and layout, this is one of the biggest changes to come to the iPhone's home screen in years and it gives iOS users similar features that Android users have had for a long time. In the same vein, Control Center will be updated in iOS 18 to include more customization options and will allow users to program quick controls form third-party apps in addition to the native options.

The Photos app is getting a big redesign in iOS 18, putting an emphasis on intelligently organized groups of photos that revolve around memories, trips and other big events. The new design ditches the old tabbed layout and will usher in a one-page design when you can view all of your photos individually, or view them by Collections. Users will also be able to filter out things like screenshots and receipts that would show up in a chronological format, but would otherwise mess up the a tightly curated group of vacation photos.

A couple of new privacy features stand out in iOS 18, namely the ability to lock and hide apps. For the former, users can lock an app so sensitive information stays behind a Face-ID or Touch-ID wall, preventing even those who you casually hand your iPhone to from seeing that information. Hiding an app, on the other hand, does exactly what you think: hides a program in a special hidden folder that others won't be able to see.

The Calculator app is getting a big overhaul in iOS 18, including improved unit conversions, a sidebar showing recent activity and integration with the Notes app. But what might be even more notable is the fact that the revamped Calculator app will not only be available on iPhones and Macs — it's coming to iPads for the first time as part of the iPadOS 18 update. Embedded within the iPadOS Calculator app is a new feature called Math Notes, which lets users write out math equations with the Apple Pencil and the app will solve many of them instantly.

iPadOS 18 will also feature a new Tab Bar, which looks similar to the Dynamic Island on iPhones. This bar makes it easier to access essential controls even when you're in apps, and depending on what you're doing, it can show up at the top of the screen or as a sidebar of sorts on the left of the display. The Notes app in iPadOS is getting another new feature called Smart Script, which will make users' handwriting more legible and less messy automatically.

macOS Sequoia

The next iteration of Apple's computer software will be called macOS Sequoia. In addition to many of the AI features also coming to iOS and iPadOS 18 as part of Apple Intelligence, the next macOS update will include iPhone mirroring, which lets users see and control their iPhone screen on a Mac screen. They'll be able to use their keyboard and trackpad to intact with the iPhone screen on their laptop, and they can even open iOS apps directly on their computers without picking up their iPhone at all.

A new Passwords app builds upon the technology of iCloud keychain to save all of users' passwords and login credentials across devices and platforms (it will be available on Windows in addition to iOS and iPadOS). Along with standard passwords, the new app can save passkeys, verification codes and more, and give users the ability to securely share passwords with others.

Other updates coming in macOS Sequoia include a snap window arrangement tool with accompanying keyboard and menu shortcuts, Presenter Preview, which lets you see what you're about to share with call partners before they see it, and gaming upgrades like improved Windows porting capabilities using Gameporting Toolkit 2. Users will also get access to Image Playground in macOS Sequoia, Apple's AI image generator built into Apple Intelligence. It provides the ability to create AI-generated images in different styles, including animation, illustration and sketch.

watchOS 11

The next software update for the Apple Watch includes two big changes: Training Load and a new Vitals app. Training Load in watchOS 11 essentially uses many of the health and fitness metrics collected during workout tracking to estimate your effort level each time. Each workout will receive a rating from one (easy) to ten (all out) that estimates how hard the user worked during that particular session.

The new Vitals app will show Apple Watch users how their vitals captured, including heart rate, compare to baseline measurements. This will hopefully allow users to better understand when something might be off and outside the "normal" range.

The Activity app on iPhone is also getting an update to accompany watchOS 11, and will allow users to customize the data they see on the homepage so they can put the most important stats to them front and center. Cycle Tracking will also get an update to include more detailed pregnancy insights, including gestational age and information about the user's health metrics that may related to pregnancy (like heart rate fluctuations).

visionOS 2

Until now, Apple's Vision Pro headset has only been available in the US. That's changing soon as the company announced the device's rollout in additional countries including Australia, Canada, China, France, Germany, Japan, Singapore and the UK in the coming months. As far as the headset's software, visionOS goes, Apple announced that visionOS 2 will add spatial photos, which adds depth to images in the Photos app, new UI gesture controls and improved Mac screen mirroring with support for higher resolutions and display sizes.

AirPods Pro audio updates

Apple briefly mentioned some software updates coming to AirPods Pro, including improved Voice Isolation, which should help the buds better pick up a user’s voice in noise environments. A new Siri Interaction is coming to AirPods Pro as well: a silent head-nod will allow users to answer an incoming call without saying a word out loud to Siri, and contrast, a shake of the head will decline a call. These silent interactions will also be applicable to messages and notifications.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/wwdc-2024-everything-apple-announced-today-including-ios-18-ai-with-apple-intelligence-and-more-184422477.html?src=rss© Apple

Apple brings a full-featured Passwords app to the Mac, iPhone, iPad and Windows

The rumors are true. Apple is adding a dedicated passwords manager app to most of its operating systems. These include macOS, iPadOS, visionOS and iOS. It’ll even work on Windows by accessing the Passwords app via iCloud. That’s pretty neat. There are way too many passwords out there.

The first-party service is powered by iCloud Keychain and will compete with some heavy hitters in the space, like LastPass and 1Password. The simply-named Passwords app will be able to list various user logins and categorize them based on service type. For instance, banking passwords would be grouped differently than social media passwords. The app will also allow users to bypass manual password input by leveraging Face ID, Touch ID and autofill.

It’s worth noting that Apple already had a password manager, but it’s not exactly beloved and has been buried in the settings page. This new app, however, is quite a compelling option for those tied into the Apple ecosystem. The company didn’t say if the app was free or if it would require a monthly subscription.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/apple-brings-a-full-featured-passwords-app-to-the-mac-iphone-ipad-and-windows-181607490.html?src=rss© Apple

Apple redesigned the Photos app in iOS 18 to intelligently organize your memories

Apple’s iOS 18 update — which the company described as the "biggest ever" — will bring major changes for the Photos app. The company previewed the redesigned, which, among other things, automatically organizes all your photos around memorable moments like trips and events.

The new version will ditch the app's current tabbed layout in favor of a single screen where you can view all your photos, albums and memories in one place. The familiar grid view of all your images will live at the top of the app, with intelligently organized “collections” below.

Apple is also making the app smarter with its new collections, which will sort your photos into album-like views based things like on recent trips and the people you spend the most time with. The feature is a bit like the existing "memories" feature in photos, in that it groups like images together and can autoplay them when you want to revisit the moment. (Though, unlike memories, collections don't include sound effects and animations.)

Photos is also more customizable with the ability to pin collections to a dedicated section of the app. And new filtering abilities will make it easier to look for specific types of pictures or weed out screenshots while browsing.

The Photos app will also benefit from Apple's new AI abilities in iOS. Photos is getting AI-powered image editing with a new "Clean Up" editing tool that can remove background objects similar to Google's "magic eraser" feature. You'll also be able to create custom stories based on your photos with a new memories feature that allows you to type a description of the moment you want to capture. "Apple Intelligence will pick out the best photos and videos based on the description, craft a storyline with chapters based on themes identified from the photos, and arrange them into a movie with its own narrative arc," the company says.

The new redesigned Photos app will be arriving with the iOS 18 update later this year.

Catch up here for all the news out of Apple's WWDC 2024.

This article originally appeared on Engadget at https://www.engadget.com/apple-redesigned-the-photos-app-in-ios-18-to-intelligently-organize-your-memories-174959393.html?src=rss© Apple

Google’s accessibility app Lookout can use your phone’s camera to find and recognize objects

Google has updated some of its accessibility apps to add capabilities that will make them easier to use for people who need them. It has rolled out a new version of the Lookout app, which can read text and even lengthy documents out loud for people with low vision or blindness. The app can also read food labels, recognize currency and can tell users what it sees through the camera and in an image. Its latest version comes with a new "Find" mode that allows users to choose from seven item categories, including seating, tables, vehicles, utensils and bathrooms.

When users choose a category, the app will be able to recognize objects associated with them as the user moves their camera around a room. It will then tell them the direction or distance to the object, making it easier for users to interact with their surroundings. Google has also launched an in-app capture button, so they can take photos and quickly get AI-generated descriptions.

The company has updated its Look to Speak app, as well. Look to Speak enables users to communicate with other people by selecting from a list of phrases, which they want the app to speak out loud, using eye gestures. Now, Google has added a text-free mode that gives them the option to trigger speech by choosing from a photo book containing various emojis, symbols and photos. Even better, they can personalize what each symbol or image means for them.

Google has also expanded its screen reader capabilities for Lens in Maps, so that it can tell the user the names and categories of the places it sees, such as ATMs and restaurants. It can also tell them how far away a particular location is. In addition, it's rolling out improvements for detailed voice guidance, which provides audio prompts that tell the user where they're supposed to go.

Finally, Google has made Maps' wheelchair information accessible on desktop, four years after it launched on Android and iOS. The Accessible Places feature allows users to see if the place they're visiting can accommodate their needs — businesses and public venues with an accessible entrance, for example, will show a wheelchair icon. They can also use the feature to see if a location has accessible washrooms, seating and parking. The company says Maps has accessibility information for over 50 million places at the moment. Those who prefer looking up wheelchair information on Android and iOS will now also be able to easily filter reviews focusing on wheelchair access.

Google made all these announcements at this year's I/O developer conference, where it also revealed that it open-sourced more code for the Project Gameface hands-free "mouse," allowing Android developers to use it for their apps. The tool allows users to control the cursor with their head movements and facial gestures, so that they can more easily use their computers and phones.

Catch up on all the news from Google I/O 2024 right here!

This article originally appeared on Engadget at https://www.engadget.com/googles-accessibility-app-lookout-can-use-your-phones-camera-to-find-and-recognize-objects-160007994.html?src=rssMicrosoft's web-based mobile game store opens in July

In a couple of months, you'll be able to get Microsoft's mobile games from its own store. Xbox President Sarah Bond has revealed at the Bloomberg Technology Summit that the company is launching a web-based store where you can download its mobile games and get add-ons or in-app purchases at a discount. Bond said the company has decided to launch a browser-based store instead of an app to make it "accessible across all devices, all countries, no matter what" so that you don't get "locked to a single ecosystem."

Microsoft will only host its own games to start with, which means it will feature a lot of titles from Activision Blizzard. If you'll recall, it snapped up the gaming developer and publisher in a $70 billion deal that closed last year. You'll most likely find Candy Crush Saga, which has apparently generated $20 billion in revenue since it launched in 2012, and Call of Duty's mobile games in the first batch of titles available for download. Bond said that Minecraft may also be one of the first games you can get.

An Xbox spokesperson told Bloomberg that this is "just the first step in [the company's] journey to building a trusted app store with its roots in gaming." Microsoft plans to open the app store to third-party publishers in the future, though it didn't share a timeline for that goal.

The company first announced its intention to launch a gaming store for Android and iOS devices last year shortly before rules under the EU's Digital Markets Act became applicable. To comply with DMA rules, Apple and Google have to allow third-party app stores to be accessible on their platforms and to offer alternative billing systems for purchases. They're also compelled to allow app sideloading, which will be a massive change for Apple, a company known for its "walled garden" approach to business.

Operators of third-party app stores will get to avoid some of the fees Google and Apple charge, but they'd still have to pay the companies for bypassing their mobile platforms' official stores. Both tech giants have already outlined how they're changing things up to comply with the DMA regulations. The companies' rivals found the changes they're making insufficient, however, prompting the European Commission to start investigating their compliance plans.

This article originally appeared on Engadget at https://www.engadget.com/microsofts-web-based-mobile-game-store-opens-in-july-090044359.html?src=rss© Candy Crush Saga

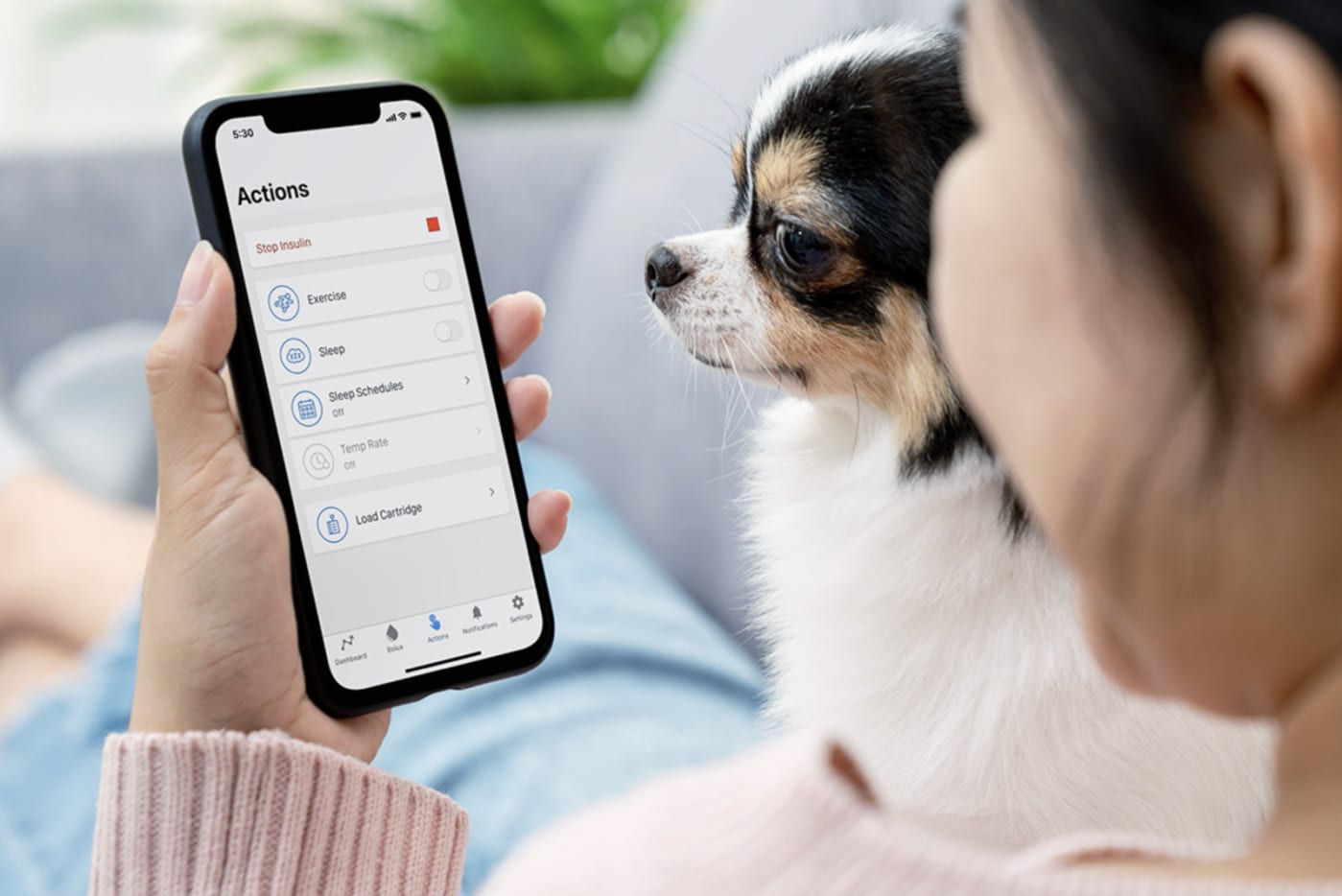

An insulin pump software bug has injured over 200 people

The US Food and Drug Administration (FDA) has issued a Class I recall for the t:connect mobile app on iOS, which is used to monitor and control the t:slim X2 insulin pump used by people with diabetes. It was supposedly the first smartphone app that can program insulin doses that the FDA had approved. The agency issued the highest level of recall it could, because the app had serious software problems that could've have caused life-threatening conditions or even death. In fact, while there were no mortalities reported, the FDA received 224 injury reports as of April 15.

According to the agency, version 2.7 of the t:connect mobile app had a bug that initiated a cycle wherein the app would crash and then would be relaunched by the iOS platform again and again. That apparently led to excessive Bluetooth communication that would drain the pump's battery and cause it to shut down earlier than the user would expect. Insulin pumps like the t:slim X2 are designed to automatically deliver insulin under the user's skin at set time intervals and whenever needed. They're supposed to take on the burden of managing the user's sugar levels so that they can go about their day without having to stop and inject themselves or if they're prone to getting hypo or hyperglycemia.

If a pump shuts down without warning and before the user expects it to, it could lead to the under-delivery of insulin. As the FDA explained in its recall, that could result in hyperglycemia and even diabetic ketoacidosis, a life-threatening complication caused by the inability of the body to turn sugar into energy due to the lack of insulin. Tandem Diabetes Care, the company behind the app and the pump, sent all affected customers an emergency notice back in March. It advised them to update their app, to monitor their pump battery level closely and to carry backup insulin supplies. The FDA's recall notice could reach potentially affected customers who may not have seen the manufacturer's alerts, however, or who may have brushed it aside. Malfunctioning insulin pumps had been linked to multiple deaths in the past, so users may want to keep a close eye on theirs regardless of the brand.

This article originally appeared on Engadget at https://www.engadget.com/an-insulin-pump-software-bug-has-injured-over-200-people-123056847.html?src=rss© Tandem Diabetes Care

Microsoft's web-based mobile game store opens in July

In a couple of months, you'll be able to get Microsoft's mobile games from its own store. Xbox President Sarah Bond has revealed at the Bloomberg Technology Summit that the company is launching a web-based store where you can download its mobile games and get add-ons or in-app purchases at a discount. Bond said the company has decided to launch a browser-based store instead of an app to make it "accessible across all devices, all countries, no matter what" so that you don't get "locked to a single ecosystem."

Microsoft will only host its own games to start with, which means it will feature a lot of titles from Activision Blizzard. If you'll recall, it snapped up the gaming developer and publisher in a $70 billion deal that closed last year. You'll most likely find Candy Crush Saga, which has apparently generated $20 billion in revenue since it launched in 2012, and Call of Duty's mobile games in the first batch of titles available for download. Bond said that Minecraft may also be one of the first games you can get.

An Xbox spokesperson told Bloomberg that this is "just the first step in [the company's] journey to building a trusted app store with its roots in gaming." Microsoft plans to open the app store to third-party publishers in the future, though it didn't share a timeline for that goal.

The company first announced its intention to launch a gaming store for Android and iOS devices last year shortly before rules under the EU's Digital Markets Act became applicable. To comply with DMA rules, Apple and Google have to allow third-party app stores to be accessible on their platforms and to offer alternative billing systems for purchases. They're also compelled to allow app sideloading, which will be a massive change for Apple, a company known for its "walled garden" approach to business.

Operators of third-party app stores will get to avoid some of the fees Google and Apple charge, but they'd still have to pay the companies for bypassing their mobile platforms' official stores. Both tech giants have already outlined how they're changing things up to comply with the DMA regulations. The companies' rivals found the changes they're making insufficient, however, prompting the European Commission to start investigating their compliance plans.

This article originally appeared on Engadget at https://www.engadget.com/microsofts-web-based-mobile-game-store-opens-in-july-090044359.html?src=rss© Candy Crush Saga

An insulin pump software bug has injured over 200 people

The US Food and Drug Administration (FDA) has issued a Class I recall for the t:connect mobile app on iOS, which is used to monitor and control the t:slim X2 insulin pump used by people with diabetes. It was supposedly the first smartphone app that can program insulin doses that the FDA had approved. The agency issued the highest level of recall it could, because the app had serious software problems that could've have caused life-threatening conditions or even death. In fact, while there were no mortalities reported, the FDA received 224 injury reports as of April 15.

According to the agency, version 2.7 of the t:connect mobile app had a bug that initiated a cycle wherein the app would crash and then would be relaunched by the iOS platform again and again. That apparently led to excessive Bluetooth communication that would drain the pump's battery and cause it to shut down earlier than the user would expect. Insulin pumps like the t:slim X2 are designed to automatically deliver insulin under the user's skin at set time intervals and whenever needed. They're supposed to take on the burden of managing the user's sugar levels so that they can go about their day without having to stop and inject themselves or if they're prone to getting hypo or hyperglycemia.

If a pump shuts down without warning and before the user expects it to, it could lead to the under-delivery of insulin. As the FDA explained in its recall, that could result in hyperglycemia and even diabetic ketoacidosis, a life-threatening complication caused by the inability of the body to turn sugar into energy due to the lack of insulin. Tandem Diabetes Care, the company behind the app and the pump, sent all affected customers an emergency notice back in March. It advised them to update their app, to monitor their pump battery level closely and to carry backup insulin supplies. The FDA's recall notice could reach potentially affected customers who may not have seen the manufacturer's alerts, however, or who may have brushed it aside. Malfunctioning insulin pumps had been linked to multiple deaths in the past, so users may want to keep a close eye on theirs regardless of the brand.

This article originally appeared on Engadget at https://www.engadget.com/an-insulin-pump-software-bug-has-injured-over-200-people-123056847.html?src=rss© Tandem Diabetes Care

Microsoft's web-based mobile game store opens in July

In a couple of months, you'll be able to get Microsoft's mobile games from its own store. Xbox President Sarah Bond has revealed at the Bloomberg Technology Summit that the company is launching a web-based store where you can download its mobile games and get add-ons or in-app purchases at a discount. Bond said the company has decided to launch a browser-based store instead of an app to make it "accessible across all devices, all countries, no matter what" so that you don't get "locked to a single ecosystem."

Microsoft will only host its own games to start with, which means it will feature a lot of titles from Activision Blizzard. If you'll recall, it snapped up the gaming developer and publisher in a $70 billion deal that closed last year. You'll most likely find Candy Crush Saga, which has apparently generated $20 billion in revenue since it launched in 2012, and Call of Duty's mobile games in the first batch of titles available for download. Bond said that Minecraft may also be one of the first games you can get.

An Xbox spokesperson told Bloomberg that this is "just the first step in [the company's] journey to building a trusted app store with its roots in gaming." Microsoft plans to open the app store to third-party publishers in the future, though it didn't share a timeline for that goal.

The company first announced its intention to launch a gaming store for Android and iOS devices last year shortly before rules under the EU's Digital Markets Act became applicable. To comply with DMA rules, Apple and Google have to allow third-party app stores to be accessible on their platforms and to offer alternative billing systems for purchases. They're also compelled to allow app sideloading, which will be a massive change for Apple, a company known for its "walled garden" approach to business.

Operators of third-party app stores will get to avoid some of the fees Google and Apple charge, but they'd still have to pay the companies for bypassing their mobile platforms' official stores. Both tech giants have already outlined how they're changing things up to comply with the DMA regulations. The companies' rivals found the changes they're making insufficient, however, prompting the European Commission to start investigating their compliance plans.

This article originally appeared on Engadget at https://www.engadget.com/microsofts-web-based-mobile-game-store-opens-in-july-090044359.html?src=rss© Candy Crush Saga

An insulin pump software bug has injured over 200 people

The US Food and Drug Administration (FDA) has issued a Class I recall for the t:connect mobile app on iOS, which is used to monitor and control the t:slim X2 insulin pump used by people with diabetes. It was supposedly the first smartphone app that can program insulin doses that the FDA had approved. The agency issued the highest level of recall it could, because the app had serious software problems that could've have caused life-threatening conditions or even death. In fact, while there were no mortalities reported, the FDA received 224 injury reports as of April 15.

According to the agency, version 2.7 of the t:connect mobile app had a bug that initiated a cycle wherein the app would crash and then would be relaunched by the iOS platform again and again. That apparently led to excessive Bluetooth communication that would drain the pump's battery and cause it to shut down earlier than the user would expect. Insulin pumps like the t:slim X2 are designed to automatically deliver insulin under the user's skin at set time intervals and whenever needed. They're supposed to take on the burden of managing the user's sugar levels so that they can go about their day without having to stop and inject themselves or if they're prone to getting hypo or hyperglycemia.

If a pump shuts down without warning and before the user expects it to, it could lead to the under-delivery of insulin. As the FDA explained in its recall, that could result in hyperglycemia and even diabetic ketoacidosis, a life-threatening complication caused by the inability of the body to turn sugar into energy due to the lack of insulin. Tandem Diabetes Care, the company behind the app and the pump, sent all affected customers an emergency notice back in March. It advised them to update their app, to monitor their pump battery level closely and to carry backup insulin supplies. The FDA's recall notice could reach potentially affected customers who may not have seen the manufacturer's alerts, however, or who may have brushed it aside. Malfunctioning insulin pumps had been linked to multiple deaths in the past, so users may want to keep a close eye on theirs regardless of the brand.

This article originally appeared on Engadget at https://www.engadget.com/an-insulin-pump-software-bug-has-injured-over-200-people-123056847.html?src=rss© Tandem Diabetes Care

The Morning After: Microsoft’s OpenAI partnership was born from Google AI envy

Emails from the Department of Justice’s antitrust case against Google revealed how Microsoft executives were alarmed by and even envious of Google’s AI lead.

In an email thread, CTO Kevin Scott wrote he was “very, very worried” about Google’s rapidly growing AI capabilities. He said he initially dismissed the company’s “game-playing stunts,” likely referring to Google’s AlphaGo models. The emails reference Gmail’s autocomplete features, which execs called “scary good.” Microsoft struggled to copy Google’s BERT-large, an AI model that deciphers the meaning and context of words in a sentence. It took the company six hours to replicate the model, while Google inched further ahead on more elaborate, bigger models.

Scott said Microsoft had “very smart” people on its machine-learning teams but their ambitions had been curbed and that their company was “multiple years behind the competition in terms of ML scale.” This all led to a billion-dollar push into OpenAI in 2019. It’s since invested $13 billion.

— Mat Smith

The biggest stories you might have missed

The Cheyenne Supercomputer is going for a fraction of its list price at auction right now

Batman: Arkham Shadow is the first big exclusive VR game for the Quest 3

May's PlayStation Plus games include Ghostrunner 2 and the modern classic Tunic

You can get these reports delivered daily direct to your inbox. Subscribe right here!

LinkedIn now has daily Wordle-style games

What connects you with a B2B marketer in West Virginia? Four letters.

LinkedIn, the career-centric social network, is getting into gaming. But the kind of earnest, word-based games your mom would let you play when you were a kid. LinkedIn describes them as “thinking-oriented games,” though the format will likely look familiar to fans of The New York Times Games app. You can only play each game once a day, and you can share your score with friends. And just maybe... strike up a conversation on how you can help each other with targeted SaaS projects. Yes, I have feelings about who hits me up on LinkedIn.

TikTok might be trying to circumvent Apple’s in-app purchase rules

It appears to be directing users to “avoid in-app service fees.”

TikTok is allegedly violating Apple’s App Store rules, with the app allowing (even recommending) particular users to purchase its coins directly from its website. TikTok has apparently given some iOS users the option to “Try recharging on tiktok.com to avoid in-app service fees” — namely Apple’s 30 percent commission on purchases, which are more likely than not passed onto those users. It’s definitely not available to all users and seems to be there for TikTok users who have previously bought a large number of coins — the TikTok whales, if you will.

Rabbit denies claims its R1 virtual assistant is a glorified Android app

Someone pulled the APK out and put it on an Android phone.

The Rabbit R1, a pocket-sized AI virtual assistant device, runs Android under the hood. Now early users have been able to tease out the R1 APK, install it on an Android phone and make it work — if not with all the features. If that’s the case, what’s the point in the $200 gadget?

In a statement sent to Android Authority, Rabbit CEO Jesse Lyu, said the Rabbit R1 is “not an Android app.” He added the R1 ran on very bespoke AOSP (Android Open Source Project) build and lower-level firmware modifications, so a local bootleg APK won’t be able to access most R1 services. We’re wrapping up our own detailed review — stay tuned.

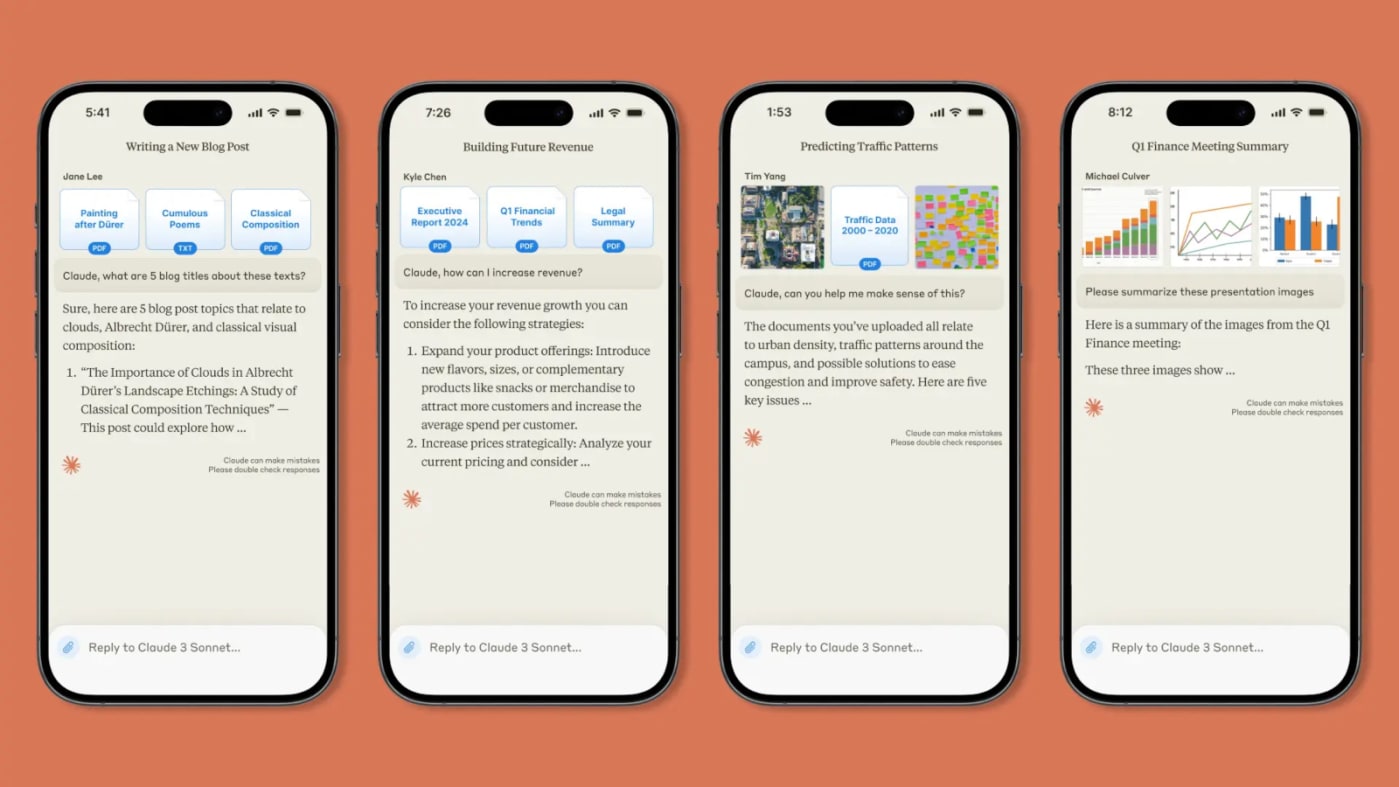

This article originally appeared on Engadget at https://www.engadget.com/the-morning-after-microsofts-openai-partnership-was-born-from-google-ai-envy-111555445.html?src=rssAnthropic now has a Claude chatbot app for iOS

Anthropic is making its Claude AI easier to access on mobile. The company has released a Claude mobile app for iOS that any user can download for free. Similar to the mobile web version of the chatbot, the app syncs users' conversations with Claude across devices, allowing them to jump from a computer to the app (or vice versa) without losing their chat history. Users will also be able to upload files and images straight from their iPhone's gallery — or take a photo on the spot — if they need Claude to process or analyze them in real time. They'll be able to download and access the Claude app whatever plan they're using, even if they're not paying for the service.

If they do decide to pay for Claude, they now have a new option other than Pro. The new Team plan provides greater usage than the Pro tier so that members can have more conversations with the chatbot. It also enables users to process longer documents, such as research papers and contracts, thanks to its 200,000 context window. The Team plan gives users access to the Claude 3 model family, as well, which includes Opus, Sonnet and Haiku. It will cost subscribers $30 per user per month, with a minimum head count of five users per team.

Back in March, Anthropic claimed in a blog post that its Claude 3 language model had outperformed ChatGPT and Google's Gemini in several key industry benchmarks. It was better at graduate-level reasoning, multilingual math and coding (among many other metrics), the company said, showing Claude 3's benchmark results against its staunchest rivals. The most powerful Claude 3 model, the Opus, even apparently showed "near-human" abilities with rapid response rates that make it ideal for more complex and time-sensitive tasks.

This article originally appeared on Engadget at https://www.engadget.com/anthropic-now-has-a-claude-chatbot-app-for-ios-075930308.html?src=rss© Anthropic

TikTok might be going around Apple's in-app purchase rules for its coins

Another day, another company tests Apple's resolve. This time, it's TikTok allegedly violating the company's rules for apps, with the video platform seemingly allowing some users to purchase its coins directly from its website. TikTok has apparently given some iOS users the option to "Try recharging on tiktok.com to avoid in-app service fees" — namely Apple's 30 percent commission on purchases.

According to photos shared on X (formerly Twitter) by David Tesler, co-founder of the app Sendit, TikTok is prompting users to save around 25 percent when purchasing coins (used to tip creators) thanks to lower third-party service fees. They can then use Apple Pay, PayPal or a credit or debit card to complete their transaction. It's unclear why only some users have access to this circumnavigation; one hypothesis is the feature was turned on for individuals who previously purchased a large number of coins.

TikTok might get banned from the app store next week

— David Tesler (@getdavenow) April 30, 2024

Why? It looks like they’re circumventing apple fee by directing users to purchase coins via external payment methods pic.twitter.com/VG8ihvsRmv

Apple notably kicked Fortnite off its app store in 2020 after Epic Games introduced discounts on the game's currency for anyone who directly purchased it. The incident set off a multi-year legal battle, with Apple reinstating Epic Games' developer account in March after the European Union began looking into the situation. More recently, Apple has faced pushback from Spotify and rejected updates that would have displayed the music streamer's pricing and allowed in-app plan purchases.

This article originally appeared on Engadget at https://www.engadget.com/tiktok-might-be-going-around-apples-in-app-purchase-rules-for-its-coins-134527587.html?src=rss© NurPhoto via Getty Images

This Startup Uses the MIT App Inventor to Teach Girls Coding

When Marianne Smith was teaching computer science in 2016 at Flathead Valley Community College, in Kalispell, Mont., the adjunct professor noticed the female students in her class were severely outnumbered, she says.

Smith says she believed the disparity was because girls were not being introduced to science, technology, engineering, and mathematics in elementary and middle school.

Code Girls United

Founded

2018

Headquarters

Kalispell, Mont.

Employees

10

In 2017 she decided to do something to close the gap. The IEEE member started an after-school program to teach coding and computer science.

What began as a class of 28 students held in a local restaurant is now a statewide program run by Code Girls United, a nonprofit Smith founded in 2018. The organization has taught more than 1,000 elementary, middle, and high school students across 38 cities in Montana and three of the state’s Native American reservations. Smith has plans to expand the nonprofit to South Dakota, Wisconsin, and other states, as well as other reservations.

“Computer science is not a K–12 requirement in Montana,” Smith says. “Our program creates this rare hands-on experience that provides students with an experience that’s very empowering for girls in our community.”

The nonprofit was one of seven winners last year of MIT Solve’s Gender Equity in STEM Challenge. The initiative supports organizations that work to address gender barriers. Code Girls United received US $100,000 to use toward its program.

“The MIT Solve Gender Equity in STEM Challenge thoroughly vets all applicants—their theories, practices, organizational health, and impact,” Smith says. “For Code Girls United to be chosen as a winner of the contest is a validating honor.”

From a restaurant basement to statewide programs

When Smith had taught her sons how to program robots, she found that programming introduced a set of logic and communication skills similar to learning a new language, she says.

Those skills were what many girls were missing, she reasoned.

“It’s critical that girls be given the opportunity to speak and write in this coding language,” she says, “so they could also have the chance to communicate their ideas.”

An app to track police vehicles

Last year Code Girls United’s advanced class held in Kalispell received a special request from Jordan Venezio, the city’s police chief. He asked the class to create an app to help the Police Department manage its vehicle fleet.

The department was tracking the location of its police cars on paper, a process that made it challenging to get up-to-date information about which cars were on patrol, available for use, or being repaired, Venezio told the Flathead Beacon.

The objective was to streamline day-to-day vehicle operations. To learn how the department operates and see firsthand the difficulties administrators faced when managing the vehicles, two students shadowed officers for 10 weeks.

The students programmed the app using Visual Studio Code, React Native, Expo Go, and GitHub.

The department’s administrators now more easily can see each vehicle’s availability, whether it’s at the repair shop, or if it has been retired from duty.

“It’s a great privilege for the girls to be able to apply the skills they’ve learned in the Code Girls United program to do something like this for the community,” Smith says. “It really brings our vision full circle.”

At first she wasn’t sure what subjects to teach, she says, reasoning that Java and other programming languages were too advanced for elementary school students.

She came across MIT App Inventor, a block-based visual programming language for creating mobile apps for Android and iOS devices. Instead of learning a coding language by typing it, students drag and drop jigsaw puzzle–like pieces that contain code to issue instructions. She incorporated building an app with general computer science concepts such as conditionals, logic flow, and variables. With each concept learned, the students built a more difficult app.

“It was perfect,” she says, “because the girls could make an app and test it the same day. It’s also very visual.”

Once she had a curriculum, she wanted to find willing students, so she placed an advertisement in the local newspaper. Twenty-eight girls signed up for the weekly classes, which were held in a diner. Assisting Smith were Beth Schecher, a retired technical professional; and Liz Bernau, a newly graduated elementary school teacher who taught technology classes. Students had to supply their own laptop.

At the end of the first 18 weeks, the class was tasked with creating apps to enter in the annual Technovation Girls competition. The contest seeks out apps that address issues including animal abandonment, safely reporting domestic violence, and access to mental health services.

The first group of students created several apps to enter in the competition, including ones that connected users to water-filling stations, provided people with information about food banks, and allowed users to report potholes. The group made it to the competition’s semifinals.

The coding program soon outgrew the diner and moved to a computer lab in a nearby elementary school. From there classes were held at Flathead Valley Community College. The program continued to grow and soon expanded to schools in other Montana towns including Belgrade, Havre, Joliet, and Polson.

The COVID-19 pandemic prompted the program to become virtual—which was “oddly fortuitous,” Smith says. After she made the curriculum available for anyone to use via Google Classroom, it increased in popularity.

That’s when she decided to launch her nonprofit. With that came a new curriculum.

What began as a class of 28 students held in a restaurant in Kalispell, Mont., has grown into a statewide program run by Code Girls United. The nonprofit has taught coding and computer science to more than 1,000 elementary, middle, and high school students. Code Girls United

What began as a class of 28 students held in a restaurant in Kalispell, Mont., has grown into a statewide program run by Code Girls United. The nonprofit has taught coding and computer science to more than 1,000 elementary, middle, and high school students. Code Girls United

Program expands across the state

Beginner, intermediate, and advanced classes were introduced. Instructors of the weekly after-school program are volunteers and teachers trained by Smith or one of the organization’s 10 employees. The teachers are paid a stipend.

For the first half of the school year, students in the beginner class learn computer science while creating apps.

“By having them design and build a mobile app,” Smith says, “I and the other teachers teach them computer science concepts in a fun and interactive way.”

Once students master the course, they move on to the intermediate and advanced levels, where they are taught lessons in computer science and learn more complicated programming concepts such as Java and Python.

“It’s important to give girls who live on the reservations educational opportunities to close the gap. It’s the right thing to do for the next generation.”

During the second half of the year, the intermediate and advanced classes participate in Code Girls United’s App Challenge. The girls form teams and choose a problem in their community to tackle. Next they write a business plan that includes devising a marketing strategy, designing a logo, and preparing a presentation. A panel of volunteer judges evaluates their work, and the top six teams receive a scholarship of up to $5,000, which is split among the members.

The organization has given out more than 55 scholarships, Smith says.

“Some of the girls who participated in our first education program are now going to college,” she says. “Seventy-two percent of participants are pursuing a degree in a STEM field, and quite a few are pursuing computer science.”

Introducing coding to Native Americans

The program is taught to high school girls on Montana’s Native American reservations through workshops.

Many reservations lack access to technology resources, Smith says, so presenting the program there has been challenging. But the organization has had some success and is working with the Blackfeet reservation, the Salish and Kootenai tribes on the Flathead reservation, and the Nakota and Gros Ventre tribes at Fort Belknap.

The workshops tailor technology for Native American culture. In the newest course, students program a string of LEDs to respond to the drumbeat of tribal songs using the BBC’s Micro:bit programmable controller. The lights are attached to the bottom of a ribbon skirt, a traditional garment worn by young women. Colorful ribbons are sewn horizontally across the bottom, with each hue having a meaning.

The new course was introduced to students on the Flathead reservation this month.

“Montana’s reservations are some of the most remote and resource-limited communities,” Smith says, “especially in regards to technology and educational opportunities.

“It’s important to give girls who live on the reservations educational opportunities to close the gap. It’s the right thing to do for the next generation.”

The 6 best Mint alternatives to replace the budgeting app that shut down

We're now living in a post-Mint world. Intuit shuttered the popular budgeting app on March 24, 2024, and suggested its millions of users switch to its other finance app, Credit Karma. I, along with 3.6 million others (as of 2021, according to Bloomberg), had been Mint users for a long time. Many of us liked the Mint app for how it easily allowed us to track all accounts in one place and monitor credit scores. It was also a great tool for sticking to a monthly spending plan and setting goals like building a rainy-day fund or paying down my mortgage faster.

I gave Credit Karma a shot in the months leading up to Mint shutting down. I was left unimpressed; it’s not a true Mint alternative, so I set out to find an app that could be. The following guide lays out my experience testing some of the most popular Mint replacement apps available today. If you’re also on the hunt for a budgeting app to replace Mint, we hope these details can help you decide which of the best budgeting apps out there could meet your needs in this post-Mint world.

How to import your financial data from Mint

Mint users should consider getting their data ready to migrate to their new budgeting app of choice soon. Unfortunately, importing data from Mint is not as easy as entering your credentials from inside your new app and hitting “import.” In fact, any app that advertises the ability to port over your stats from Mint is just going to have you upload a CSV file of transactions and other data.

To download a CSV file from Mint, do the following:

Sign into Mint.com and hit Transactions in the menu on the left side of the screen.

Select an account, or all accounts.

Scroll down and look for “export [number] transactions” in smaller print.

Your CSV file should begin downloading.

Note: Downloading on a per-account basis might seem more annoying, but could help you get set up on the other side, if the app you’re using has you importing transactions one-for-one into their corresponding accounts.

How we tested

Before I dove into the world of budgeting apps, I had to do some research. To find a list of apps to test, I consulted trusty ol’ Google (and even trustier Reddit); read reviews of popular apps on the App Store; and also asked friends and colleagues what budget tracking apps they might be using. Some of the apps I found were free, just like Mint. These, of course, show loads of ads (excuse me, “offers”) to stay in business. But most of the available apps require paid subscriptions, with prices typically topping out around $100 a year, or $15 a month. (Spoiler: My top pick is cheaper than that.)

Since this guide is meant to help Mint users find a permanent replacement, any services I chose to test needed to do several things: import all of your account data into one place; offer budgeting tools; and track your spending, net worth and credit score. Except where noted, all of these apps are available for iOS, Android and on the web.

Once I had my shortlist of six apps, I got to work setting them up. For the sake of thoroughly testing these apps (and remember, I really was looking for a Mint alternative myself), I made a point of adding every account to every budgeting app, no matter how small or immaterial the balance. What ensued was a veritable Groundhog Day of two-factor authentication. Just hours of entering passwords and one-time passcodes, for the same banks half a dozen times over. Hopefully, you only have to do this once.

The best Mint alternative: Quicken Simplifi

No pun intended, but what I like about Quicken Simplifi is its simplicity. Whereas other budgeting apps try to distinguish themselves with dark themes and customizable emoji, Simplifi has a clean user interface, with a landing page that you just keep scrolling through to get a detailed overview of all your stats. These include your top-line balances; net worth; recent spending; upcoming recurring payments; a snapshot of your spending plan; top spending categories; achievements; and any watchlists you’ve set up. You can also set up savings goals elsewhere in the app. I also appreciate how it offers neat, almost playful visualizations without ever looking cluttered. I felt at home in the mobile and web dashboards after a day or so, which is faster than I adapted to some competing services (I’m looking at you, YNAB and Monarch).

Getting set up with Simplifi was mostly painless. I was particularly impressed at how easily it connected to Fidelity; not all budget trackers do, for whatever reason. This is also one of the only services I tested that gives you the option of inviting a spouse or financial advisor to co-manage your account. One thing I would add to my initial assessment of the app, having used it for a few months now: I wish Simplifi offered Zillow integration for easily tracking your home value (or at least a rough estimate of it). Various competitors including Monarch Money and Copilot Money work with Zillow, so clearly there's a Zillow API available for use. As it stands, Simplifi users must add real estate manually like any other asset.

In practice, Simplifi miscategorized some of my expenses, but nothing out of the ordinary compared to any of these budget trackers. As you’re reviewing transactions, you can also mark if you’re expecting a refund, which is a unique feature among the services I tested. Simplifi also estimated my regular income better than some other apps I tested. Most of all, I appreciated the option of being able to categorize some, but not all, purchases from a merchant as recurring. For instance, I can add my two Amazon subscribe-and-saves as recurring payments, without having to create a broad-strokes rule for every Amazon purchase.

The budgeting feature is also self-explanatory. Just check that your regular income is accurate and be sure to set up recurring payments, making note of which are bills and which are subscriptions. This is important because Simplifi shows you your total take-home income as well as an “income after bills” figure. That number includes, well, bills but not discretionary subscriptions. From there, you can add spending targets by category in the “planned spending” bucket. Planned spending can also include one-time expenditures, not just monthly budgets. When you create a budget, Simplifi will suggest a number based on a six-month average.

Not dealbreakers, but two things to keep in mind as you get started: Simplifi is notable in that you can’t set up an account through Apple or Google. There is also no option for a free trial, though Quicken promises a “30-day money back guarantee.”

The best Mint alternative (runner-up): Monarch Money

Monarch Money grew on me. My first impression of the budgeting app, which was founded by a former Mint product manager, was that it's more difficult to use than others on this list, including Simplifi, NerdWallet and Copilot. And it is. Editing expense categories, adding recurring transactions and creating rules, for example, is a little more complicated than it needs to be, especially in the mobile app. (My advice: Use the web app for fine-tuning details.) Monarch also didn’t get my income right; I had to edit it.

Once you’re set up, though, Monarch offers an impressive level of granularity. In the budgets section, you can see a bona fide balance sheet showing budgets and actuals for each category. You'll also find a forecast, for the year or by month. And recurring expenses can be set not just by merchant, but other parameters as well. For instance, while most Amazon purchases might be marked as “shopping,” those for the amounts of $54.18 or $34.18 are definitely baby supplies, and can be automatically marked as such each time, not to mention programmed as recurring payments. Weirdly, though, there’s no way to mark certain recurring payments as bills, specifically.