Kamala Harris' Dishonest and Stupid Price Control Proposal

When you've caused a problem, deflect! At least, that seems to be the strategy of Vice President and Democratic presidential candidate Kamala Harris, who spent the last several years as part of an administration that presided over a growing mismatch between Americans' pay and the cost of living. Rather than take responsibility for the decline of the dollar's purchasing power, she blames businesses that were forced to raise prices as a result. And she wants to fix the problem she helped cause by restricting those prices, never mind the inevitable consequences for the availability of goods and services.

Wait, I Thought This Was an Economy To Be Proud Of?

First though, let's journey back to 2023 when Harris claimed to be proud of the state of the economy.

"That is called Bidenomics, and we are very proud of Bidenomics," she insisted last August in a speech where she also trumpeted, "the unemployment rate is near its lowest level in over half a century. Wages are up. Inflation has fallen 12 months in a row."

Now though, the vice president and would-be chief executive huffs, "When I am President, it will be a day one priority to bring down prices. I'll take on big corporations that engage in illegal price gouging and corporate landlords that unfairly raise rents on working families."

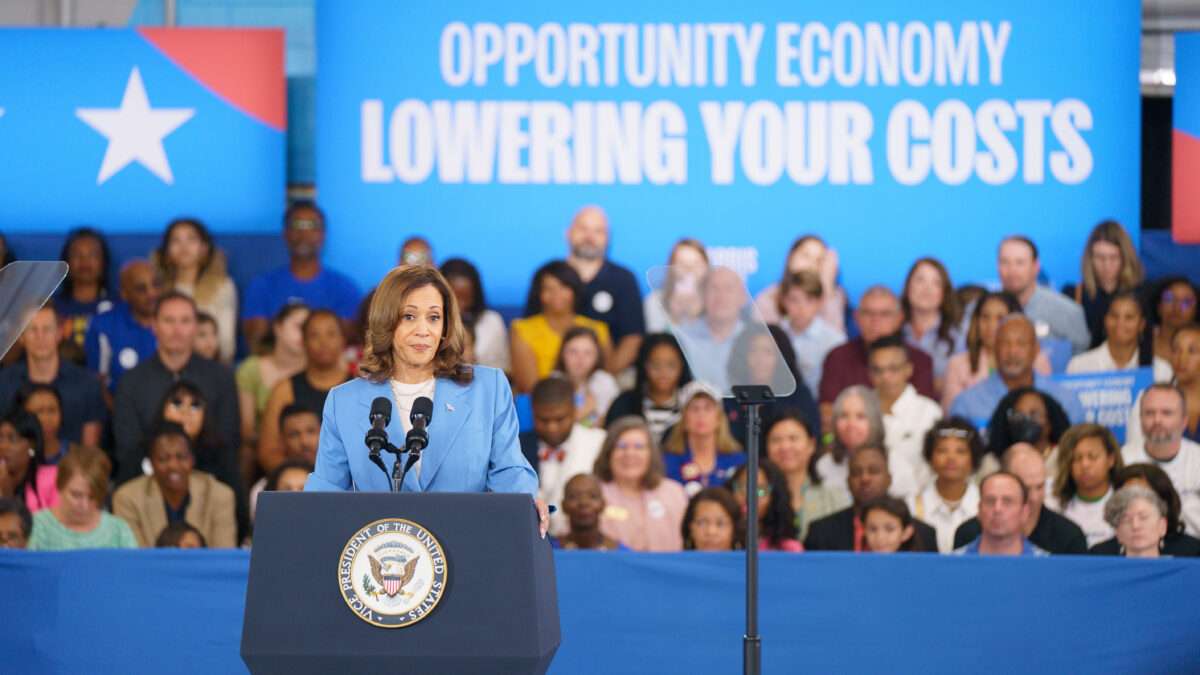

And that's exactly what she proposed in her speech last week which recognized concerns over the cost of living and included a host of schemes for greater government involvement in the economy, including "the first ever federal ban on price gouging on food" amidst worries over grocery bills.

It's nice that Harris recognized Americans' concerns over making ends meet. Less nice, though, was pretending that cost concerns are a result of mean corporations rather than bad policy. Also not so nice is her insistence on doubling down on bad policy with even worse cost controls.

Let's emphasize that there's little doubt government policy is at the root of inflation.

Government Officials Should Get the Blame for Those High Prices

"Inflation comes when aggregate demand exceeds aggregate supply," wrote economist John Cochrane of the Hoover Institution and the Cato Institute in a March piece for the International Monetary Fund. "The source of demand is not hard to find: in response to the pandemic's dislocations, the US government sent about $5 trillion in checks to people and businesses, $3 trillion of it newly printed money, with no plans for repayment."

"Fiscal stimulus boosted the consumption of goods without any noticeable impact on production, increasing excess demand pressures in good markets," admitted the Federal Reserve Board of Governors as early as July 2022. "As a result, fiscal support contributed to price tensions."

Even Jim Tankersley and Jeanna Smialek of The New York Times, a paper which almost reflexively supports Democrats, concede "most economists" say that factors including "snarled supply chains, a sudden shift in consumer buying patterns, and the increased customer demand fueled by stimulus from the government and low rates from the Federal Reserve…are far more responsible than corporate behavior for the rise in prices."

And the rise in prices is substantial. The U.S. Bureau of Labor Statistic's inflation calculator shows that in July 2024, it took $120.25 to buy what $100 purchased in January 2021 when Joe Biden and Kamala Harris took office. That's on average; some sectors have seen greater or lesser inflation.

What Price Gouging?

Especially when it comes to groceries, it's difficult to make a case for "price gouging." A New York University Stern School of Business annual survey shows a net profit margin of 1.18 percent for retail grocery stores last year. That's down a bit from when the Biden administration took office (you can check annual data here). Kroger, the industry giant that is frequently portrayed as a greedy bogeyman, recently enjoyed a slightly higher net profit margin of 1.43 percent; over the last 15 years, its profits briefly reached as high as 3.02 percent in 2018. (The Cato Institute's Scott Lincicome does a good dive into food-industry economics on X.)

So much for Harris's deflection. But then there's her scheme for price controls to address the higher prices brought by government policy. Such controls have such a well-documented track record that they heap stupidity onto Harris's dishonesty.

A History of Price Control Failures

In 2022, when inflation was surging and the dollar's declining purchasing power had many Americans looking for the sort of "solutions" that Harris now offers, Federal Reserve Bank of St. Louis economist Christopher J. Neely pointed out that schemes for government-imposed price controls date back to the Code of Hammurabi and "have costs whose severity depends on the broadness of the control and the degree to which it changes the price from the free-market price."

Free market prices, he emphasized, "allocate scarce goods and services to buyers who are most willing and able to pay for them" and "signal that a good is valued and that producers can profit by increasing the quantity supplied." In the absence of such allocation and signals, you get shortages of goods and services. With grocery stores, that means empty shelves—little to buy at the controlled prices.

There's more to it than that. Neely pointed out that you also get cheapened goods to reduce production costs, gamesmanship to get around rules, and black markets that entirely defy the law. He recommended that "price controls should stay in the history books."

The Washington Post editorial board, usually as protective of Democrats as the Times, agrees. It pointed out that Harris didn't define what constituted the "excessive" profits she wanted to target and that "thankfully, this gambit by Ms. Harris has been met with almost instant skepticism, with many critics citing President Richard M. Nixon's failed price controls from the 1970s."

From the Code of Hammurabi to former President Nixon, with a detour for the Roman Emperor Diocletian—who, economist John Cochrane notes, torpedoed production and trade with price restrictions—such controls have been irresistible for government officials. That's because bad economics all too often makes for good—or, at least, effective—public relations. People who tell pollsters they think corporations are raking in 36 percent profits (the real average across industries is closer to 8 percent) can be convinced by clever politicians that they're being ripped off and need government intervention.

What politicians won't admit is that it's their own policies that put the public in distress to begin with, and that their latest schemes, if implemented, will make matters worse.

The post Kamala Harris' Dishonest and Stupid Price Control Proposal appeared first on Reason.com.