Skyrim, Shadr's Debt To Sapphire Paid » Kabalyero

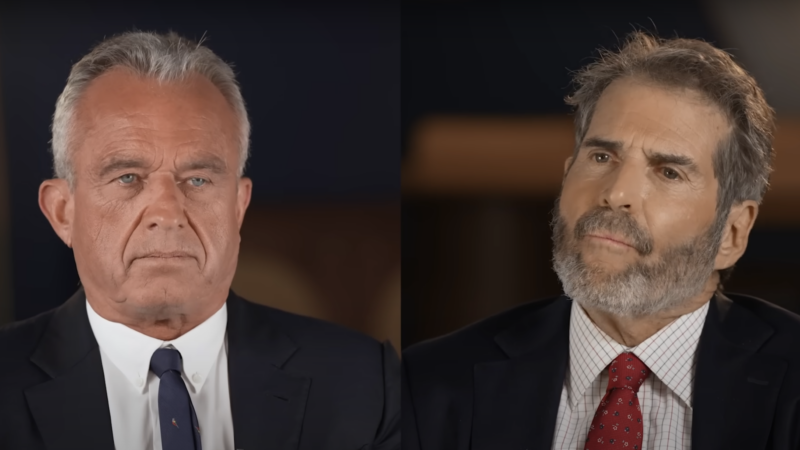

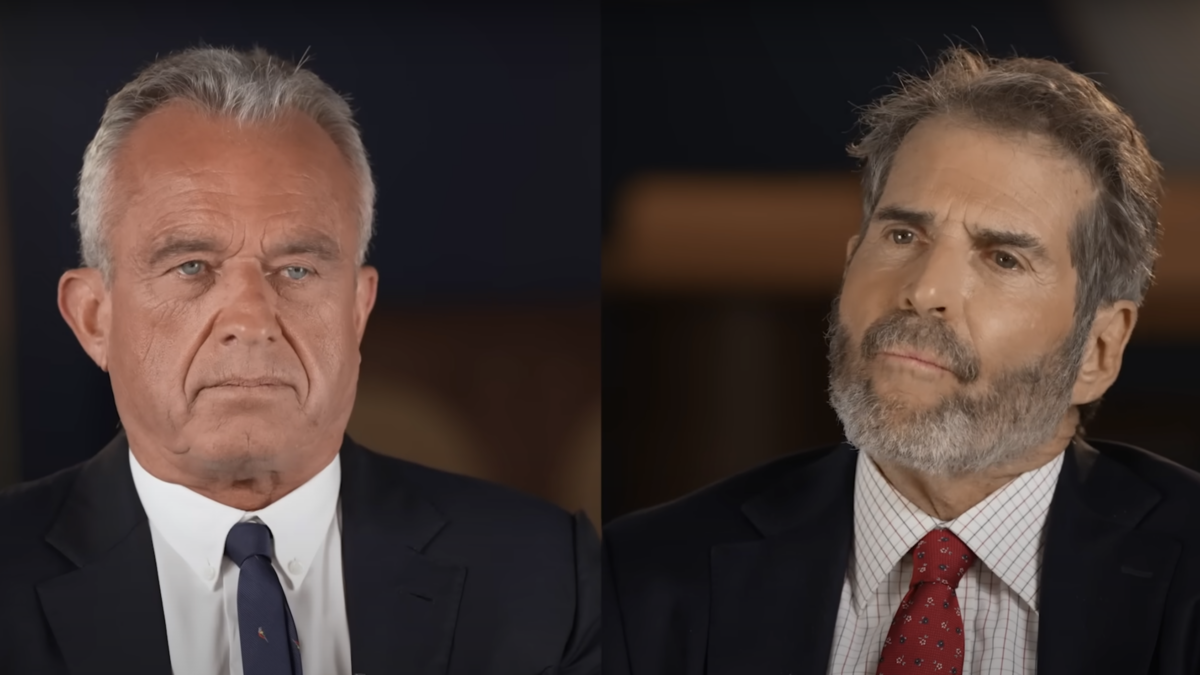

IN THIS VIDEO: Sapphire was speaking to Shadr. She was collecting her money from Shadr but Shadr was not able to pay Sapphire because Sapphire did something bad that affected Shadr's financial status.

In the dimly lit room, Sapphire faced Shadr with a mixture of anticipation and trepidation. The air was thick with tension, as the moment of reckoning had arrived. Sapphire, with her hands clasped tightly in front of her, was there to collect the debt owed to her, a sum that had been agreed upon under much different circumstances.

Shadr, on the other hand, sat slumped in his chair, his eyes avoiding Sapphire's steady gaze. The room was silent except for the ticking of the clock, marking the seconds that felt like hours to both of them. Shadr's financial situation had taken a turn for the worse, a direct consequence of an indiscretion committed by Sapphire. It was an act that she had thought inconsequential at the time, but its ripples had extended far and wide, eventually crashing into Shadr's life with the force of a tsunami.

The money that Sapphire sought was no longer within Shadr's grasp. His business, once thriving and prosperous, was now a shadow of its former self. The clients had disappeared, the contracts had been canceled, and the steady stream of income had dried up to nothing more than a trickle. All because Sapphire, in a moment of weakness, had made a choice that now haunted both their lives.

Sapphire remembered the day all too well. It was a decision made in haste, a solution to a problem that seemed insurmountable at the time. But the solution had been a poison, one that had seeped into the foundation of Shadr's enterprise and eroded it from within. She had not meant to cause harm, yet the damage was done, and the cost was more than just monetary.

As they sat in silence, the weight of guilt pressed heavily on Sapphire's shoulders. She knew that demanding payment from Shadr was futile, yet she was bound by her own needs, her own debts that clamored for attention. The cycle of cause and effect, of action and consequence, was playing out before her, and she was powerless to stop it.

Shadr finally looked up, his eyes meeting Sapphire's. There was no anger there, only resignation and a deep, unspoken understanding. Words were unnecessary; their shared history spoke volumes more than any conversation could. Sapphire slowly unclasped her hands and placed them on her lap, her posture softening.

"I'm sorry," she whispered, the words barely audible. It was an apology for more than just the current predicament. It was an acknowledgment of the pain she had caused, the trust she had broken, and the friendship she had jeopardized.

Shadr nodded, a gesture of forgiveness that was as much for himself as it was for Sapphire. They both knew that some debts went beyond money, beyond the tangible. They were debts of the heart, of the soul, and those were the ones that took the longest to repay.

In the end, Sapphire left without the money she had come for, but with something much more valuable. She left with the hope of redemption and the possibility of rebuilding what had been broken. And as she stepped out into the fading light of the day, she made a silent vow to right the wrongs of the past, not with words, but with actions.

For Shadr, the path ahead was uncertain, but he was not alone. The bonds that had been strained were not broken, and in the darkness that surrounded him, he found a glimmer of light. It was the light of forgiveness, of second chances, and of new beginnings. And with that light to guide him, he knew that the road to recovery, though long and arduous, was one he was ready to travel.

Hello fellow gamers! I'm here playing and livestreaming Skyrim Legendary Edition. The Elder Scrolls V: Skyrim Legendary Edition combines the base game with three DLC add-ons: Dawnguard, Hearthfire, and Dragonborn. It introduces features like legendary skills, mounted combat, and a higher difficulty mode. A must-play for fans of epic fantasy adventures!

For comments, questions or reactions then please post them in the comments section below. Also, please like the video, share the video, follow the channel and enable notifications.

Thank you for watching!

Links

• Rumble » https://rumble.com/register/kabalyero

• Twitter »

https://twitter.com/kabalyero

• Website » https://www.kabalyero.info

•

Ko-fi » https://ko-fi.com/kabalyero

• Youtube »

https://www.youtube.com/kabalyero

• ProtonVPN »

https://go.getproton.me/SHtQ

PC Specs

• CPU » AMD Ryzen 5 3400G

• GPU » NVIDIA GeForce GTX 1050

• RAM » 16

GB Generic Memory

FTC Disclosure: This post or video contains affiliate links, which means I may receive a commission for purchases made through my links.

#skyrim #skyrimle #oldrim