What about the layoffs at Meta and Twitter? Elon is crazy! WTF???

I first arrived in Silicon Valley in 1977 — 45 years ago. I was 24 years old and had accepted a Stanford fellowship paying $2,575 for the academic year. My on-campus apartment rent was $175 per month and a year later I’d buy my first Palo Alto house for $57,000 (sold 21 years later for $990,000). It was an exciting time to be living and working in Silicon Valley. And it still is. We’re right now in a period of economic confusion and reflection when many of the loudest voices have little to no sense of history. Well my old brain is crammed with history and I’m here to tell you that the current situation — despite the news coverage — is no big deal. This, too, shall pass.

But what about the layoffs at Meta and Twitter? Elon is crazy! WTF???

On February 25, 1981, Apple Computer CEO Mike Scott fired 40 percent of the company’s engineering staff at a time when sales were doubling month-over-month and the company had no budgets because there was no way they could spend money fast enough to need budgets. Scott, who left Apple, himself, two months later, said he fired all those engineers and support staff because he feared four year-old Apple was becoming “complacent.” People were gone by the end of the day, when Scott held a companywide beer bust.

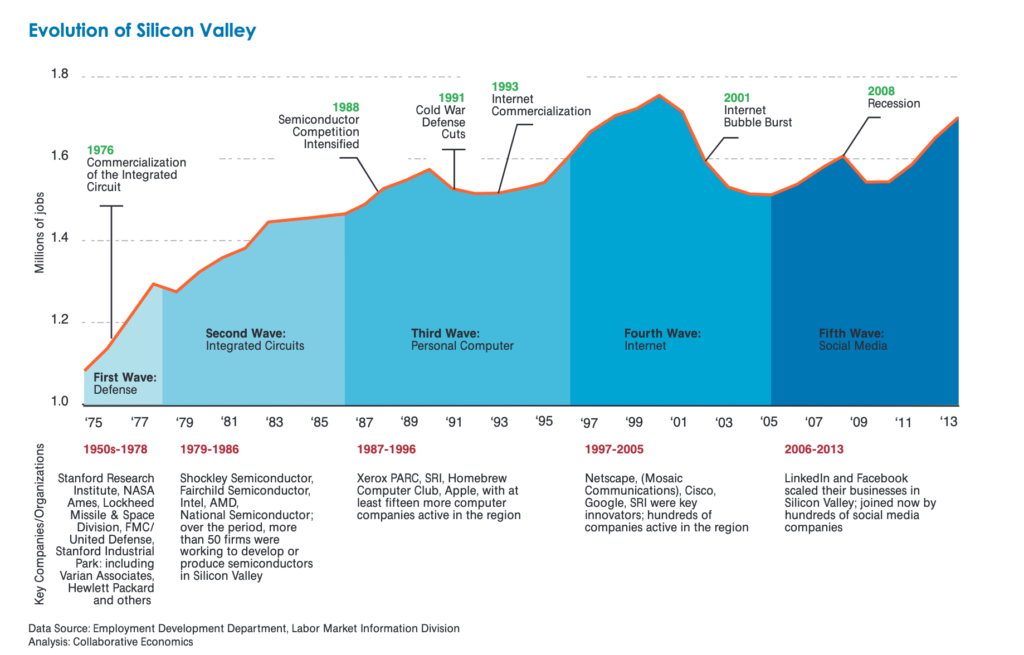

Cataclysmic change is par for the course in both startup culture and high tech. If there is going to be a next wave the previous wave has to die. Above is a chart I found from 2015 that shows the Silicon Valley economy starting in 1976. If we were to update this chart there would be a more recent boom, post social media, that I would label Artificial Intelligence, not to be confused with the late-1980s Artificial Intelligence bust that we’ve all forgotten about.

That original AI debacle is significant because it was caused by over-enthusiasm. The idea of AI made perfect sense in 1987 — the exact same sense it makes today — but nobody really understood how much computing power would be required to make those dreams come true. If AI was impractical in 1987 but is practical today thanks to Moore’s Law, how bad was our aim, exactly?

Our aim was pathetic and fortunes were lost on that pathos.

Let’s do the math. The original AI funding boom began in the late 1980s. Implicit in the VC model at the time was it taking no more than two Moore’s Law cycles from initiating the wave to launching real products. If VCs were funding companies in 1987, they expected big things from one or more of those startups by 1990. Moore’s Law said the cost of computing drops by 50 percent every 18 months so that implies that VCs in 1987 and the founders who were pitching to those VCs thought that AI would be technically practical by 1990 at which point a basic unit of computing power that cost one 1987 dollar would cost 25 cents in 1990.

IF AI is indeed economically practical today (some people still aren’t convinced that it is) mid-2021 marked 23 complete Moore’s Law cycles, meaning the computing power that cost $1 in 1987 had been reduced to $0.00000006.

Venture capitalists who bet several hundred million 1987 dollars that AI would have some chance of being economically practical at $0.25, were wrong by 48 million X.

It’s easy to look back, make these calculations, and feel smug, but that’s not even close to my point. My point is that the very VCs who lost all that money are generally zillionaires today. They kept betting on what was, for the most part, a growing tech economy.

The most important part of being a successful venture capitalist in the last 40 years has been maintaining some dry powder for future investments and staying in the game.

I could easily argue that AI in 1987 looks very similar to the metaverse in 2021. Meta (formerly Facebook) is losing $10 billion per year betting on its metaverse strategy. Recent layoffs suggest that Meta CEO Mark Zuckerberg is reevaluating his expected timeline for success.

How long can Zuckerberg afford to continue dumping billions into metaverse development? Given Meta’s corporate structure giving Zuckerberg personal voting control of the company, that question comes down to how long Meta will have enough excess cashflow to cover the costs. IF Meta is cutting its burn rate in half with these layoffs (a good argument I think) Zuckerberg can continue spending at this rate… forever. This assumes Meta continues to make lots of money with current products, but it also identifies Zuck as probably the only person in the history of tech who could make this bet pay off IF the meta verse actually becomes the next big thing.

It will be interesting to see what happens with Meta. Zuck might just run out of energy or — more likely — some competing next big thing may come along to distract him. I’m not sure it really matters much.

What does matter is that in high tech change is the norm, flux is nearly constant, and what we are seeing in the current weakness is probably change that should have happened years ago but for all the cheap money.

Silicon Valley relies on startups for ideas and growth. Startups require cheap office space and engineers looking for work. Boom and bust is not a bad thing for Silicon Valley it’s how Silicon Valley evolves.

This too shall pass.

The post What about the layoffs at Meta and Twitter? Elon is crazy! WTF??? first appeared on I, Cringely.

Digital Branding

Web Design Marketing