Enad Global 7 Reports on a Quiet Q1 2024 and Zero Work Injuries in 2023

A couple weeks back Enad Global 7 issued their financials for the first quarter of 2024 and I was doing something else… I think I was in Ione, CA that day… anyway, I am finally getting around to mentioning it.

Not that there is a lot to mention. The report straight up says it was a quiet quarter with no major releases and an continued decline in users for Big Blue Bubble’s My Singing Monsters title that saw a huge surge in popularity about 18 months back.

- As expected, Q1 was a “quieter” quarter, reflecting limited planned releases

- No major product and content releases for the period

- MSM lower level performance as expected

- Market weakness pressuring our 3rd party service business units

They didn’t even follow up on the Q4 2023 surprise announcement about the sale of the PlanetSide IP, though we did find out later that the IP somehow ended up with Toadman, another of EG7’s studios, leaving one to wonder what was going on. No further details have been provided.

So earning were down in Q1 2024. All that quiet.

The LTM side of the chart are the “last twelve months” totals marked every quarter, which is supposed to more indicative of how the company is doing overall than a strictly quarter focused view… and EG7 is down on that view as well.

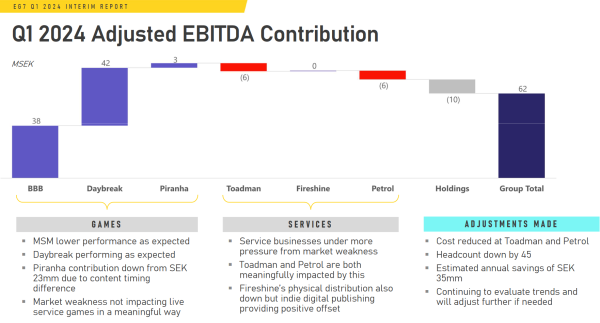

Summing up the quarter in the chart they showed who was contributing to the bottom line.

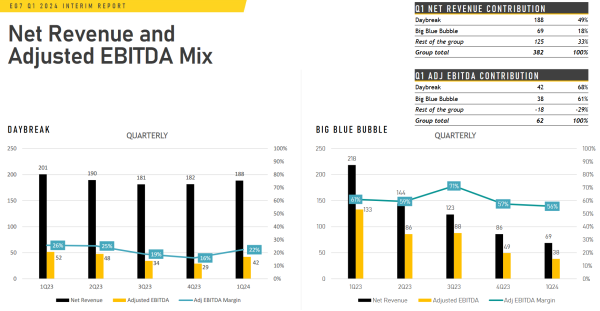

As noted above, My Singing Monsters was down, but our friends at Daybreak were chugging along as expected in a quarter with no big releases.

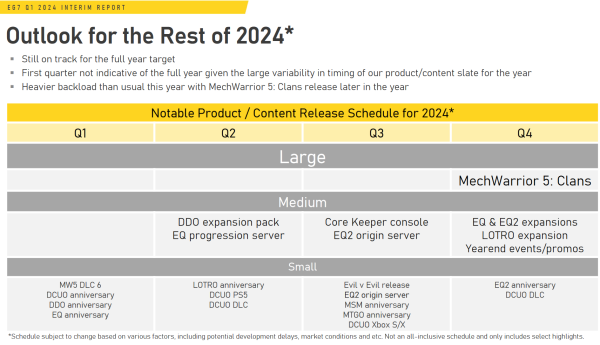

Daybreak was even up a bit in Q1 and has held steady during the rise and decline of My Singing Monsters. But Daybreak has a few “medium” events in 2024 to keep it going as this chart indicates.

The only “large” event for the year is MechWarrior 5: Clans.

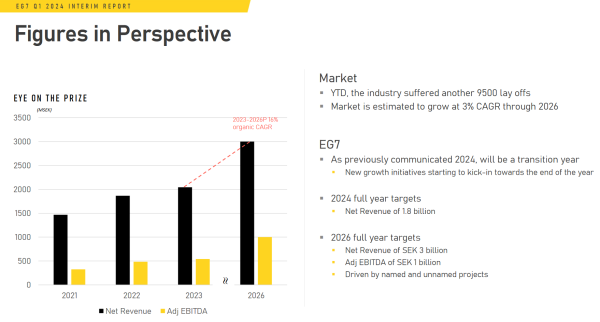

As part of this quiet quarter EG7 took a moment to remind people that things are bad all over in the video game market, but they are sticking to their goad of 3 Billion SEK in earnings in 2026, with that growth kicking in any minute now.

We’ll see how that shakes out with the Q2 results.

But next up, on June 7th, is the first dividend payment, the reaction to capital management investors demanding that EG7 not hold cash reserves when they could be just handing that money to shareholders. EG7 is taking a cautious approach to that, but the shareholder meeting coming up on June 19th will no doubt be a sounding as to whether to voracious maw of Wall Street is momentarily sated or if they will demand more.

Also, I missed when EG7 released their final 2023 company report. That is worth a glance and I linked it at the end of the post along with all the usual suspects. I did pull a couple of charts out just because I thought they were interesting.

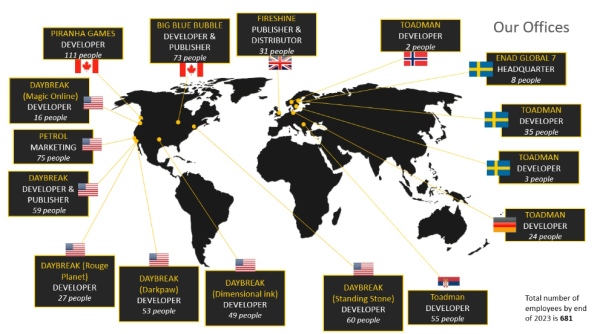

The first is the staffing levels of the various units that are part of EG7, totaling up to 736 people.

The Daybreak total at the end of 2023 was 264 people (about as many as I hear work on World of Warcraft these days) or about 36% of EG7’s total, broken out into the following groups:

- Daybreak – Standing Stone (LOTRO/DDO) – 60

- Daybreak – Developer & Publisher – 59

- Daybreak – Darkpaw (EQ/EQII) – 53

- Daybreak – Dimensional Ink (DCUO) – 49

- Daybreak – Rogue Planet (PlanetSide 2) – 27

- Daybreak – Magic Online – 16

And then there was a chart about some random demographic metrics for the company which they decided to report on.

Cyber attacks were down, as were reported sick days. I imagine those sick days were all reported in Europe where they require those sorts of benefits by law. Meanwhile, female staff declined in a number of groups… though the seem to be sneaking in a new female member of the board as according to the report she was only elevated in 2024. Details.

Anyway, EG7 made the “slow quarter” excuse, which you can do once in a while. Now to see if they can light a fire under Q2. If they don’t the capital management investors may start howling again for the company to be parted out and sold again.

Related:

- EG7 – Investor Relations Page

- EG7 – Q1 2024 Interim Report

- EG7 – Q1 2024 Investor Presentation

- EG7 – 2023 Annual Report

- Simply Wall St – There’s A Lot To Like About EG7’s Upcoming Dividend

- Massively OP – EG7 Q1 2024: Daybreak still mum on PlanetSide 2, new H1Z1 game hires lead designer

- Massively OP – EG7’s 2023 annual report claims Daybreak and SSG collectively count 264 staffers