RFK Jr. Pays Lip Service to the Debt While Pushing Policies That Would Increase It

Robert F. Kennedy Jr. won applause at the Libertarian National Convention by criticizing government lockdowns and deficit spending, and saying America shouldn't police the world.

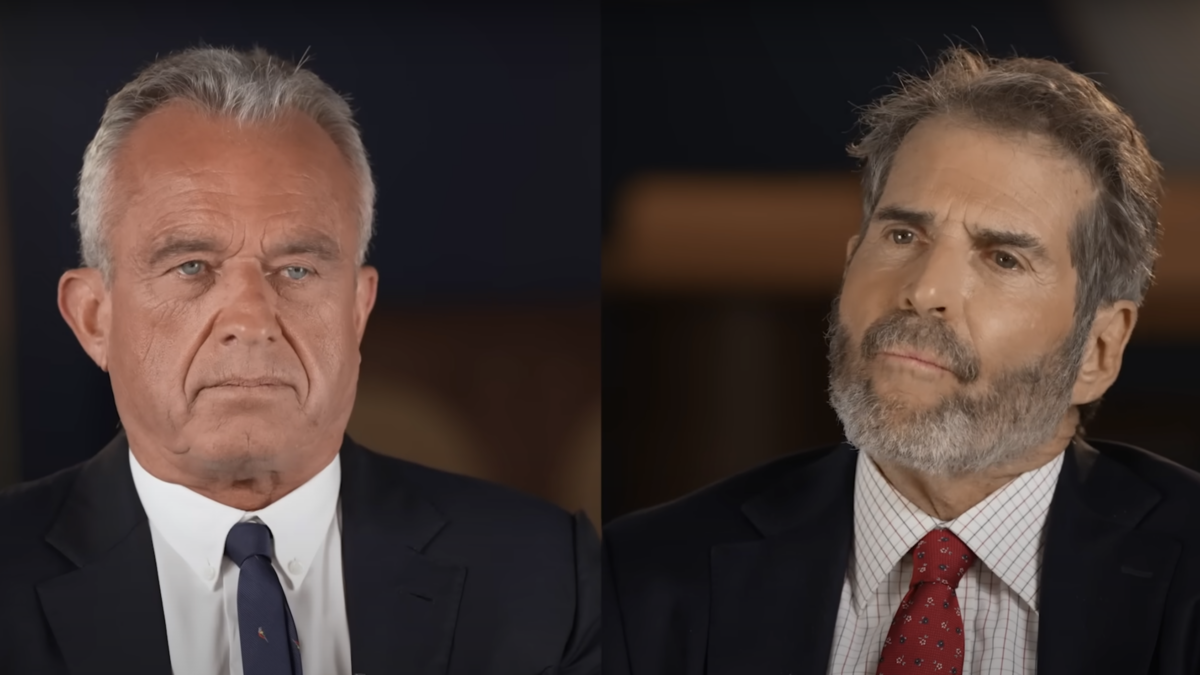

It made me want to interview him. This month, I did.

He said intelligent things about America's growing debt:

"President Trump said that he was going to balance the budget and instead he (increased the debt more) than every president in United States history—$8 trillion. President Biden is on track now to beat him."

It's good to hear a candidate actually talk about our debt.

"When the debt is this large…you have to cut dramatically, and I'm going to do that," he says.

But looking at his campaign promises, I don't see it.

He promises "affordable" housing via a federal program backing 3 percent mortgages.

"Imagine that you had a rich uncle who was willing to cosign your mortgage!" gushes his campaign ad. "I'm going to make Uncle Sam that rich uncle!"

I point out that such giveaways won't reduce our debt.

"That's not a giveaway," Kennedy replies. "Every dollar that I spend as president is going to go toward building our economy."

That's big government nonsense, like his other claim: "Every million dollars we spend on child care creates 22 jobs!"

Give me a break.

When I pressed him about specific cuts, Kennedy says, "I'll cut the military in half…cut it to about $500 billion….We are not the policemen of the world."

"Stop giving any money to Ukraine?" I ask.

"Negotiate a peace," Kennedy replies. "Biden has never talked to Putin about this, and it's criminal."

He never answered whether he'd give money to Ukraine. He did answer about Israel.

"Yes, of course we should,"

"[Since] you don't want to cut this spending, what would you cut?"

"Israel spending is rather minor," he responds. "I'm going to pick the most wasteful programs, put them all in one bill, and send them to Congress with an up and down vote."

Of course, Congress would just vote it down.

Kennedy's proposed cuts would hardly slow down our path to bankruptcy. Especially since he also wants new spending that activists pretend will reduce climate change.

At a concert years ago, he smeared "crisis" skeptics like me, who believe we can adjust to climate change, screaming at the audience, "Next time you see John Stossel and [others]… these flat-earthers, these corporate toadies—lying to you. This is treason, and we need to start treating them now as traitors!"

Now, sitting with him, I ask, "You want to have me executed for treason?"

"That statement," he replies, "it's not a statement that I would make today….Climate is existential. I think it's human-caused climate change. But I don't insist other people believe that. I'm arguing for free markets and then the lowest cost providers should prevail in the marketplace….We should end all subsidies and let the market dictate."

That sounds good: "Let the market dictate."

But wait, Kennedy makes money from solar farms backed by government guaranteed loans. He "leaned on his contacts in the Obama administration to secure a $1.6 billion loan guarantee," wrote The New York Times.

"Why should you get a government subsidy?" I ask.

"If you're creating a new industry," he replies, "you're competing with the Chinese. You want the United States to own pieces of that industry."

I suppose that means his government would subsidize every industry leftists like.

Yet when a wind farm company proposed building one near his family's home, he opposed it.

"Seems hypocritical," I say.

"We're exterminating the right whale in the North Atlantic through these wind farms!" he replies.

I think he was more honest years ago, when he complained that "turbines…would be seen from Cape Cod, Martha's Vineyard… Nantucket….[They] will steal the stars and nighttime views."

Kennedy was once a Democrat, but now Democrats sue to keep him off ballots. Former Clinton Labor Secretary Robert Reich calls him a "dangerous nutcase."

Kennedy complains that Reich won't debate him.

"Nobody will," he says. "They won't have me on any of their networks."

Well, obviously, I will.

I especially wanted to confront him about vaccines.

In a future column, Stossel TV will post more from our hourlong discussion.

COPYRIGHT 2024 BY JFS PRODUCTIONS INC.

The post RFK Jr. Pays Lip Service to the Debt While Pushing Policies That Would Increase It appeared first on Reason.com.