By Adam Kovac, Karen Heyman, and Liz Allan.

India approved the construction of two fabs and a packaging house, for a total investment of about $15.2 billion, according to multiple sources. One fab will be jointly owned by Tata and Taiwan’s Powerchip. The second fab will be a joint investment between CG Power, Japan’s Renesas Electronics, and Thailand’s Stars Microelectronics. Tata will run the packaging facility, as well. India expects these efforts will add 20,000 advanced technology jobs and 60,000 indirect jobs, according to the Times of India. The country has been talking about building a fab for at least the past couple of decades, but funding never materialized.

The U.S. Department of Commerce (DoC) issued a CHIPS Act-based Notice of Funding Opportunity for R&D to establish and accelerate domestic capacity for advanced packaging substrates and substrate materials. The U.S. Secretary of Commerce said the government is prioritizing CHIPS Act funding for projects that will be operational by 2030 and anticipates America will produce 20% of the world’s leading-edge logic chips by the end of the decade.

The top three foundries plan to implement backside power delivery as soon as the 2nm node, setting the stage for faster and more efficient switching in chips, reduced routing congestion, and lower noise across multiple metal layers. But this novel approach to optimizing logic performance depends on advances in lithography, etching, polishing, and bonding processes.

Intel spun out Altera as a standalone FPGA company, the culmination of a rebranding and reorganization of its former Programmable Solutions Group. The move follows Intel’s decision to keep Intel Foundry at arm’s length, with a clean line between the foundry and the company’s processor business.

Multiple new hardware micro-architecture vulnerabilities were published in the latest Common Weakness Enumeration release this week, all related to transient execution (CWE 1420-1423).

The U.S. Office of the National Cyber Director (ONCD) published a technical report calling for the adoption of memory safe programming languages, aiming to reduce the attack surface in cyberspace and anticipate systemic security risk with better diagnostics. The DoC also is seeking information ahead of an inquiry into Chinese-made connected vehicles “to understand the extent of the technology in these cars that can capture wide swaths of data or remotely disable or manipulate connected vehicles.”

Quick links to more news:

Design and Power

Manufacturing and Test

Automotive

Security

Pervasive Computing and AI

Events

Design and Power

Micron began mass production of a new high-bandwidth chip for AI. The company said the HBM3E will be a key component in NVIDIA’s H2000 Tensor Core GPUs, set to begin shipping in the second quarter of 2024. HBM is a key component of 2.5D advanced packages.

Samsung developed a 36GB HBM3E 12H DRAM, saying it sets new records for bandwidth. The company achieved this by using advanced thermal compression non-conductive film, which allowed it to cram 12 layers into the area normally taken up by 8. This is a novel way of increasing DRAM density.

Keysight introduced QuantumPro, a design and simulation tool, plus workflow, for quantum computers. It combines five functionalities into the Advanced Design System (ADS) 2024 platform. Keysight also introduced its AI Data Center Test Platform, which includes pre-packaged benchmarking apps and dataset analysis tools.

Synopsys announced a 1.6T Ethernet IP solution, including 1.6T MAC and PCS Ethernet controllers, 224G Ethernet PHY IP, and verification IP.

Tenstorrent, Japan’s Leading-Edge Semiconductor Technology Center (LSTC) , and Rapidus are co-designing AI chips. LSTC will use Tenstorrent’s RISC-V and Chiplet IP for its forthcoming edge 2nm AI accelerator.

This week’s Systems and Design newsletter features these top stories:

- 2.5D Integration: Big Chip Or Small PCB: Defining whether a 5D device is a PCB shrunk to fit into a package or a chip that extends beyond the limits of a single die can have significant design consequences.

- Commercial Chiplets: Challenges of establishing a commercial chiplet.

- Accellera Preps New Standard For Clock-Domain Crossing: New standard aims to streamline the clock-domain crossing flow.

- Thinking Big: From Chips To Systems: Aart de Geus discusses the shift from chips to systems, next-generation transistors, and what’s required to build multi-die devices.

- Integration challenges for RISC-V: Modifying the source code allows for democratization of design, but it adds some hurdles for design teams (video).

Demand for high-end AI servers is driven by four American companies, which will account for 60% of global demand in 2024, according to Trendforce. NVIDIA is projected to continue leading the market, with AMD closing the gap due its lower cost model.

The EU consortium PREVAIL is accepting design proposals as it seeks to develop next-gen edge-AI technologies. Anchors include CEA-Leti, Fraunhofer-Gesellschaft, imec, and VTT, which will use their 300mm fabrication, design, and test facilities to validate prototypes.

Siemens joined an initiative to expand educational opportunities in the semiconductor space around the world. The Semiconductor Education Alliance was launched by Arm in 2023 and focuses on helping teach skills in IC design and EDA.

Q-CTRL announced partnerships with six firms that it says will expand access to its performance-management software and quantum technologies. Wolfram, Aqarios, and qBraid will integrate Q-CTRL’s Fire Opal technology into their products, while Qblox, Keysight, and Quantware will utilize Q-CTRL’s Boulder Opal hardware system.

NTT, Red Hat, NVIDIA, and Fujitsu teamed up to provide data pipeline acceleration and contain orchestration technologies targeted at real-time AI analysis of massive data sets at the edge.

Manufacturing and Test

The U.S. Department of Energy (DOE)’s Office of Electricity launched the American-Made Silicon Carbide (SiC) Packaging Prize. This $2.25 million contest invites competitors to propose, design, build, and test state-of-the-art SiC semiconductor packaging prototypes.

Applied Materials introduced products and solutions for patterning issues in the “angstrom era,” including line edge roughness, tip-to-tip spacing limitations, bridge defects, and edge placement errors.

imec reported progress made in EUV processes, masks and metrology in preparation for high-NA EUV. It also identified advanced node lithography and etch related processes that contribute the most to direct emissions of CO2, along with proposed solutions.

proteanTecs will participate in the Arm Total Design ecosystem, which now includes more than 20 companies united around a charter to accelerate and simplify the development of custom SoCs based on Arm Neoverse compute subsystems.

NikkeiAsia took an in-depth look at Japan’s semiconductor ecosystem and concluded it is ripe for revival with investments from TSMC, Samsung, and Micron, among others. TrendForce came to a similar conclusion, pointing to the fast pace of Japan’s resurgence, including the opening of TSMC’s fab.

FormFactor closed its sale of its Suzhou and Shanghai companies to Grand Junction Semiconductor for $25M in cash.

The eBeam Initiative celebrated its 15th anniversary and welcomed a new member, FUJIFILM. The group also uncorked its fourth survey of its members technology using deep learning in the photomask-to-wafer manufacturing flow.

Automotive

Apple shuttered its electric car project after 10 years of development. The chaotic effort cost the company billions of dollars, according to The New York Times.

Infineon released new automotive programmable SoCs with fifth-gen human machine interface (HMI) technology, offering improved sensitivity in three packages. The MCU offers up to 84 GPIOs and 384 KB of flash memory. The company also released automotive and industrial-grade 750V G1 discrete SiC MOSFETs aimed at applications such as EV charging, onboard chargers, DC-DC converters, energy, solid state circuit breakers, and data centers.

Cadence expanded its Tensilica IP portfolio to boost computation for automotive sensor fusion applications. Vision, radar, lidar, and AI processing are combined in a single DSP for multi-modal, sensor-based system designs.

Ansys will continue translating fast computing into fast cars, as the company’s partnership with Oracle Red Bull Racing was renewed. The Formula 1 team uses Ansys technology to improve car aerodynamics and ensure the safety of its vehicles.

Lazer Sport adopted Siemens’ Xcelerator portfolio to connect 3D design with 3D printing for prototyping and digital simulation of its sustainable KinetiCore cycling helmet.

The chair of the U.S. Federal Communications Commission (FCC) suggested automakers that sell internet-connected cars should be subject to a telecommunications law aiming to protect domestic violence survivors, reports CNBC. This is due to emerging cases of stalking through vehicle location tracking technology and remote control of functions like locking doors or honking the horn.

BYD‘s CEO said the company does not plan to enter the U.S. market because it is complicated and electrification has slowed down, reports Yahoo Finance. Meanwhile, the first shipment of BYD vehicles arrived in Europe, according to DW News.

Ascent Solar Technologies’ solar module products will fly on NASA’s upcoming Lightweight Integrated Solar Array and AnTenna (LISA-T) mission.

Security

Researchers at Texas A&M University and the University of Delaware proposed the first red-team attack on graph neural network (GNN)-based techniques in hardware security.

A panel of four experts discuss mounting concerns over quantum security, auto architectures, and supply chain resiliency.

Synopsys released its ninth annual Open Source Security and Risk Analysis report, finding that 74% of code bases contained high-risk open-source vulnerabilities, up 54% since last year.

President Biden issued an executive order to prevent the large-scale transfer of Americans’ personal data to countries of concern. Types of data include genomic, biometric, personal health, geolocation, financial, and other personally identifiable information, which bad actors can use to track and scam Americans.

The National Institute of Standards and Technology (NIST) released Cybersecurity Framework (CSF) 2.0 to provide a comprehensive view for managing cybersecurity risk.

The EU Agency for Cybersecurity (ENISA) published a study on best practices for cyber crisis management, saying the geopolitical situation continues to impact the cyber threat landscape and planning for threats and incidents is vital for crisis management.

The U.S. Department of Energy (DOE) announced $45 million to protect the energy sector from cyberattacks.

The National Security Agency (NSA), the Federal Bureau of Investigation (FBI), and others published an advisory on Russian cyber actors using compromised routers. Also the Cybersecurity and Infrastructure Security Agency (CISA), the UK National Cyber Security Centre (NCSC), and partners advised of tactics used by Russian Foreign Intelligence Service cyber actors to gain initial access into a cloud environment.

CISA, the FBI, and the Department of Health and Human Services (HHS) updated an advisory concerning the ALPHV Blackcat ransomware as a service (RaaS), which primarily targets the healthcare sector.

CISA also published a guide to support university cybersecurity clinics and issued other alerts.

Pervasive Computing and AI

Renesas expanded its RZ family of MPUs with a single-chip AI accelerator that offers 10 TOPS per watt power efficiency and delivers AI inference performance of up to 80 TOPS without a cooling fan. The chip is aimed at next-gen robotics with vision AI and real-time control.

Infineon launched dual-phase power modules to help data centers meet the power demands of AI GPU platforms. The company also released a family of solid-state isolators to deliver faster switching with up to 70% lower power dissipation.

Fig. 1: Infineon’s dual phase power modules: Source: Infineon

Fig. 1: Infineon’s dual phase power modules: Source: Infineon

Amber Semiconductor announced a reference design for brushless motor applications using its AC to DC conversion semiconductor system to power ST‘s STM32 MCUs.

Micron released its universal flash storage (UFS) 4.0 package at just 9×13 mm, built on 232-layer 3D NAND and offering up to 1 terabyte capacity to enable next-gen phone designs and larger batteries.

LG and Meta teamed up to develop extended reality (XR) products, content, services, and platforms within the virtual space.

Microsoft and Mistral AI partnered to accelerate AI innovation and to develop and deploy Mistral’s next-gen large language models (LLMs).

Microsoft’s vice chair and president announced the company’s AI access principles, governing how it will operate AI datacenter infrastructure and other AI assets around the world.

Singtel and VMware partnered to enable enterprises to manage their connectivity and cloud infrastructure through the Singtel Paragon platform for 5G and edge cloud.

Keysight was selected as the Test Partner for the Deutsche Telekom Satellite NB-IoT Early Adopter Program, providing an end-to-end NB-IoT NTN testbed that allows designers and developers to validate reference designs for solutions using 3GPP Release 17 (Rel-17) NTN standards.

Global server shipments are predicted to increase by 2.05% in 2024, with AI servers accounting for about 12%, reports TrendForce. Also, the smartphone camera lens market is expected to rebound in 2024 with 3.8% growth driven by AI-smartphones, to reach about 4.22 billion units, reports TrendForce.

Yole released a smartphone camera comparison report with a focus on iPhone evolution and analysis of the structure, design, and teardown of each camera module, along with the CIS dimensions, technology node, and manufacturing processes.

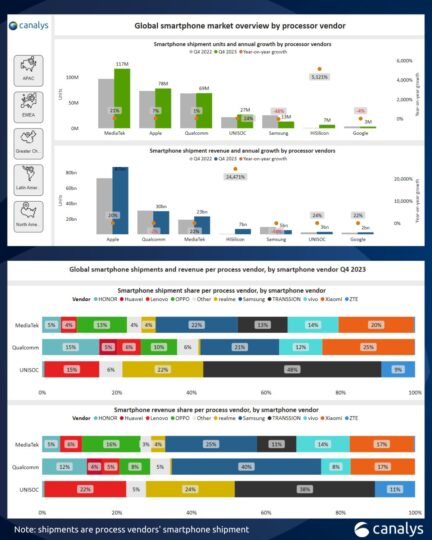

Counterpoint released a number of 2023 reports on smartphone shipments by country and operator migrations to 5G.

Events

Find upcoming chip industry events here, including:

|

|

|

| Event |

Date |

Location |

| International Symposium on FPGAs |

Mar 3 – 5 |

Monterey, CA |

| DVCON: Design & Verification |

Mar 4 – 7 |

San Jose, CA |

| ISES Japan 2024: International Semiconductor Executive Summit |

Mar 5 – 6 |

Tokyo, Japan |

| ISS Industry Strategy Symposium Europe |

Mar 6 – 8 |

Vienna, Austria |

| GSA International Semiconductor Conference |

Mar 13 – 14 |

London |

| Device Packaging Conference (DPC 2024) |

Mar 18 – 21 |

Fountain Hills, AZ |

| GOMACTech |

Mar 18 – 21 |

Charleston, South Carolina |

| SNUG Silicon Valley |

Mar 20 – 21 |

Santa Clara, CA |

| All Upcoming Events |

|

|

|

|

|

Upcoming webinars are here, including topics such as digital twins, power challenges in data centers, and designing for 112G interface compliance.

Further Reading and Newsletters

Read the latest special reports and top stories, or check out the latest newsletters:

Systems and Design

Low Power-High Performance

Test, Measurement and Analytics

Manufacturing, Packaging and Materials

Automotive, Security and Pervasive Computing

The post Chip Industry Week In Review appeared first on Semiconductor Engineering.